Benefits of XSP Options

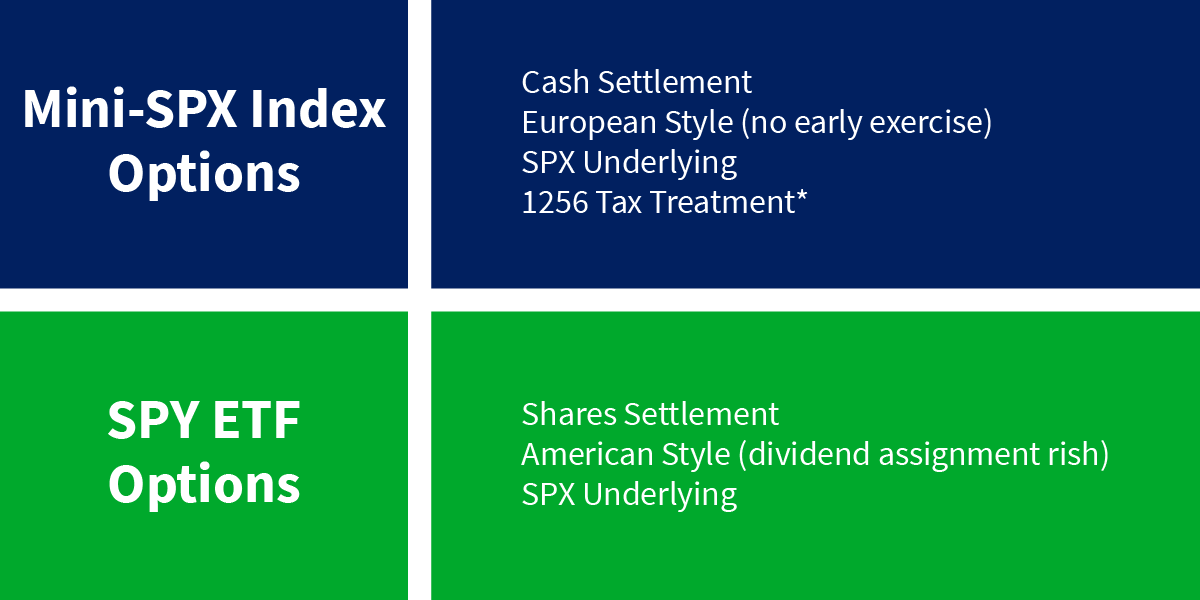

- Cash Settlement & European Exercise

- Trading account credited/debited in cash, no delivery of unwanted shares or market exposure. European style is only exercised at expiration, eliminating risk of early assignment

- Learn More

- Certainty of Settlement, No Contra-Exercise Risk

- Cash settled European style options exercise at expiration, unlike American style, which may be exercised OTM after market close — eliminating potential economic and tax risk for writers

- Covered Margin Treatment

- Offset SPY or IVV ETF exposure on a "covered" basis in a margin account**

- Learn More

- Global Trading Hours

- Unlike ETF options, XSP options trade extended hours from 8:15 p.m. to 9:15 a.m. ET. View Global Trading Hours****

- Mini Contract

- Greater flexibility with smaller contracts.

$4500 SPX = $450 XSP - Learn More

- 60/40 Tax Treatment

- Capital gains may benefit from 60/40 tax treatment*

- Learn More

XSP VS. SPY

Discover the benefits of index options vs. ETF options.

XSP Use Cases

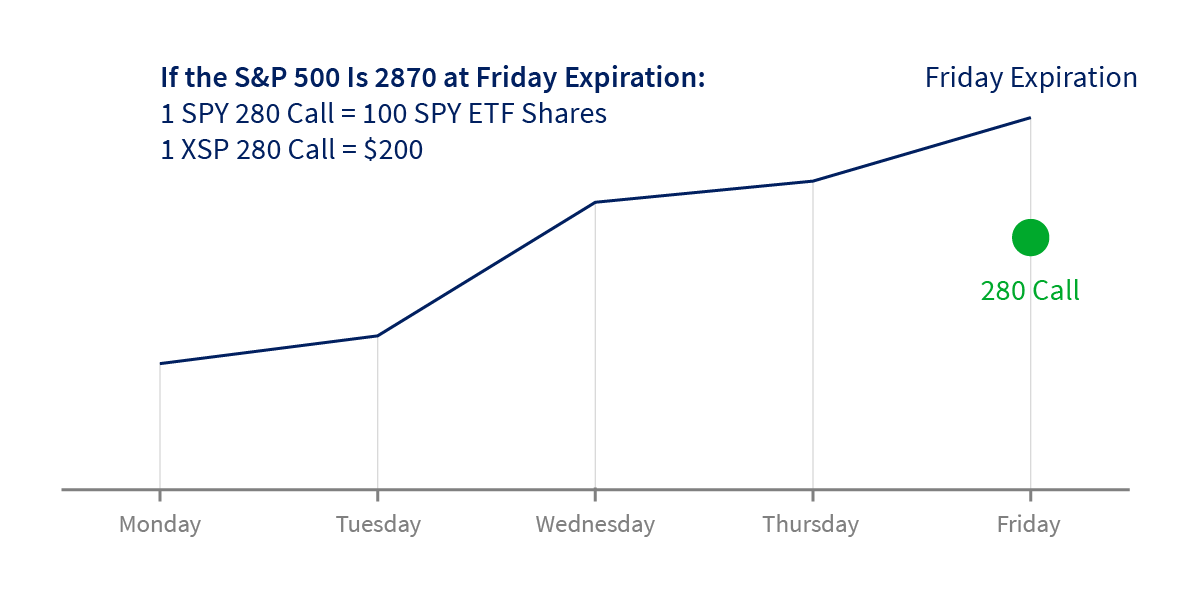

The benefits of index options let you trade right up to market close on expiration day.

Benefits of XSP

Cash settlement, 60/40 tax treatment, global trading hours and more.

Advantages of XSP versus ETF Options in Fast Moving Markets

Comparison Calculator:

S&P 500 (SPX®) and Mini-SPX (XSP℠) Index Options

Trading XSP

XSP options trade on Cboe's Hybrid Trading System, which provides investors with the combined advantages of electronic trading and an open-outcry market on a single platform.

Comparison of S&P 500® Option Products

| XSP (Mini-SPX®) Index Options | SPX® Index Options | SPX Weekly and End of Month | Nanos S&P 500 Index Options | SPDR® S&P 500® ETF Options | |

|---|---|---|---|---|---|

| Options Chain | XSP | SPX | SPX | NANOS | SPY |

| Root Ticker Symbol | XSP | SPX | SPXW | NANOS | SPY |

| AM or PM Settlement | PM | AM | PM | PM | PM |

| Settlement Date*** | Mon., Tue., Wed., Th., Fri., 3rd Fri. and Last Trading Day of Month | 3rd Friday | Mon., Tue., Wed., Th., Fri., 3rd Fri. and Last Trading Day of Month | Mon., Wed., Fri. | Mon., Wed., Fri., 3rd Fri. and Last Trading Day of Month |

| Approximate Notional Size (If S&P 500 Index is 4,500) | $45,000 | $450,000 | $450,000 | $450 | $45,000 |

| Settlement Type | Cash | Cash | Cash | Cash | Physical Shares of ETF |

| Exercise Style | European | European | European | European | American |

| Global Trading Hours Available**** | Yes | Yes | Yes | No | No |

| Tax Treatment* | May benefit from 60% long term, 40% short-term capital gains | May benefit from 60% long term, 40% short-term capital gains | May benefit from 60% long term, 40% short-term capital gains | May benefit from 60% long term, 40% short-term capital gains | Standard |

XSP Weekly Options

Whether it's trading around specific events, such as earnings announcements or economic data reports, or executing overwriting or spread-trading strategies, Cboe XSP weekly options allow traders the granularity to more closely tailor their trades to meet their needs. And for traders executing premium collection strategies, XSP weekly options provide the opportunity to collect premium 52 times per year rather than 12.

XSP weekly options are offered with Monday, Tuesday, Wednesday, Thursday, and Friday settlements. For Friday settlements, options contract expirations occur on non-standard Friday expirations throughout the year. Similarly, Monday, Tuesday, Wednesday, and Thursday XSP Weeklys options settlements may expire on any Monday, Tuesday, Wednesday, or Thursday of the month, other than a Monday, Tuesday, Wednesday, or Thursday that coincides with an end-of-month expiration date.

XSP Monday, Tuesday, Wednesday, Thursday, and Friday Weeklys options are typically listed on Friday, Monday, Tuesday, Wednesday, and Thursday, respectively and will expire on their expiration date. If a standard or EOM options contract settlement exists in a week that coincides with a typical Weekly expiration date, a Weekly expiration will not exist on that expiration day. (The term Weeklys refers to the fact that the contracts are listed every week, not that they are seven-day contracts). Settlement processes for XSP weeklys are the same as their standard options counterparts (index, ETF, etc.). See the contract specification for more information.

* Under section 1256 of the Tax Code, profit and loss on transactions in certain exchange-traded options, including SPX Options, are entitled to be taxed at a rate equal to 60% long-term and 40% short-term capital gain or loss, provided that the investor involved and the strategy employed satisfy the criteria of the Tax Code. Investors should consult with their tax advisors to determine how the profit and loss on any particular option strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations.

** Cboe Regulatory Circular RG15-183 notes that Cboe rules allow a short position in a cash-settled-index option established and carried in a margin account to receive covered margin treatment if the short option position is offset in the same account by an equivalent or greater position in an index-tracking ETF that is based on the same index that underlies the short option(s) and provided the investor's brokerage firm has such policies in place.

*** In the case of a holiday on the settlement date, the settlement date is moved back one business day (e.g. from Friday to Thursday), with the exception of Monday Weeklys, where the settlement date will move forward one business day (i.e. Monday to Tuesday). In addition, no SPX or XSP EOW, Monday Weeklys, Tuesday Weeklys, Wednesday Weeklys or Thursday Weeklys will be listed that would have an expiration date that coincides with the expiration date of a traditional SPX or XSP option, or SPX or XSP EOM option.

**** Global Trading Hours (GTH) The trading hours for options on the SPX, SPXW (SPX Weeklys and SPX End-of-Month), and XSP (Mini-SPX) begin at 8:15 p.m. Eastern time and end at 9:15 a.m. Eastern time. Please visit the Global Trading Hours page for more details.