The Dispersion Index

The Cboe S&P 500 Dispersion Index (DSPX℠) measures the expected dispersion in the S&P 500® over the next 30 calendar days, as calculated from the prices of S&P 500 index options and the prices of single stock options of selected S&P 500 constituents, using a modified version of the VIX® methodology.

In contrast to "realized dispersion" — a measure of independent movement observed in the components of a diversified portfolio — the Dispersion Index is a forward-looking implied measure. The index may provide an indication of the market's perception of the near-term opportunity set for diversification or, equivalently, as an indication of the market's perception of the near-term intensity of idiosyncratic risk in the S&P 500's constituents.

Dispersion Index

For streaming values, subscribe to Cboe Global Indices Feed

Why a Dispersion Index?

The Dispersion Index was created to provide market participants with a transparent, standardized and accurate measure of 30-day forward S&P 500 dispersion expectations. The Dispersion Index provides an indicator for the market’s expectation of the magnitude of idiosyncratic movements in S&P 500 constituent prices over the next 30 days.

Among other applications, the Dispersion Index may help portfolio managers assess the opportunity set for stock picking and alpha generation. For income investors, dispersion can be used to assess the relative attractiveness of over- or under-writing at the single stock versus the S&P 500 Index level.

The Dispersion Index maybe used in the future as the basis of both listed- and unlisted-derivatives contracts, potentially including futures and options, which may allow market participants to manage their exposure to S&P 500 dispersion to express direction views on future dispersion, or to efficiently transfer risk between S&P 500 index options and options based on the underlying S&P 500 constituents.

Demystifying Dispersion with the DSPX Index, by Mandy Xu

What is Dispersion and What Does the DSPX Index Tell Us?

Introducing the Dispersion Index DSPX, by Dr. Tim Edwards

Making Sense of the Dispersion Index:

Volatility Insights with Mandy Xu

Relationship between the VIX® Index and the Dispersion Index

The VIX Index is connected to the Dispersion Index both theoretically through their respective index methodologies and practically via the observed statistical relationships between the two index levels.

From a theoretical perspective, the Dispersion Index uses the level of the VIX Index as an explicit input to its calculation, where its square used to represent the expected variance of the S&P 500 over the next 30 days. The Dispersion Index also uses a version of the VIX Index methodology to calculate expected variances for the S&P 500's constituents, which are also inputs to the Dispersion Index calculation.

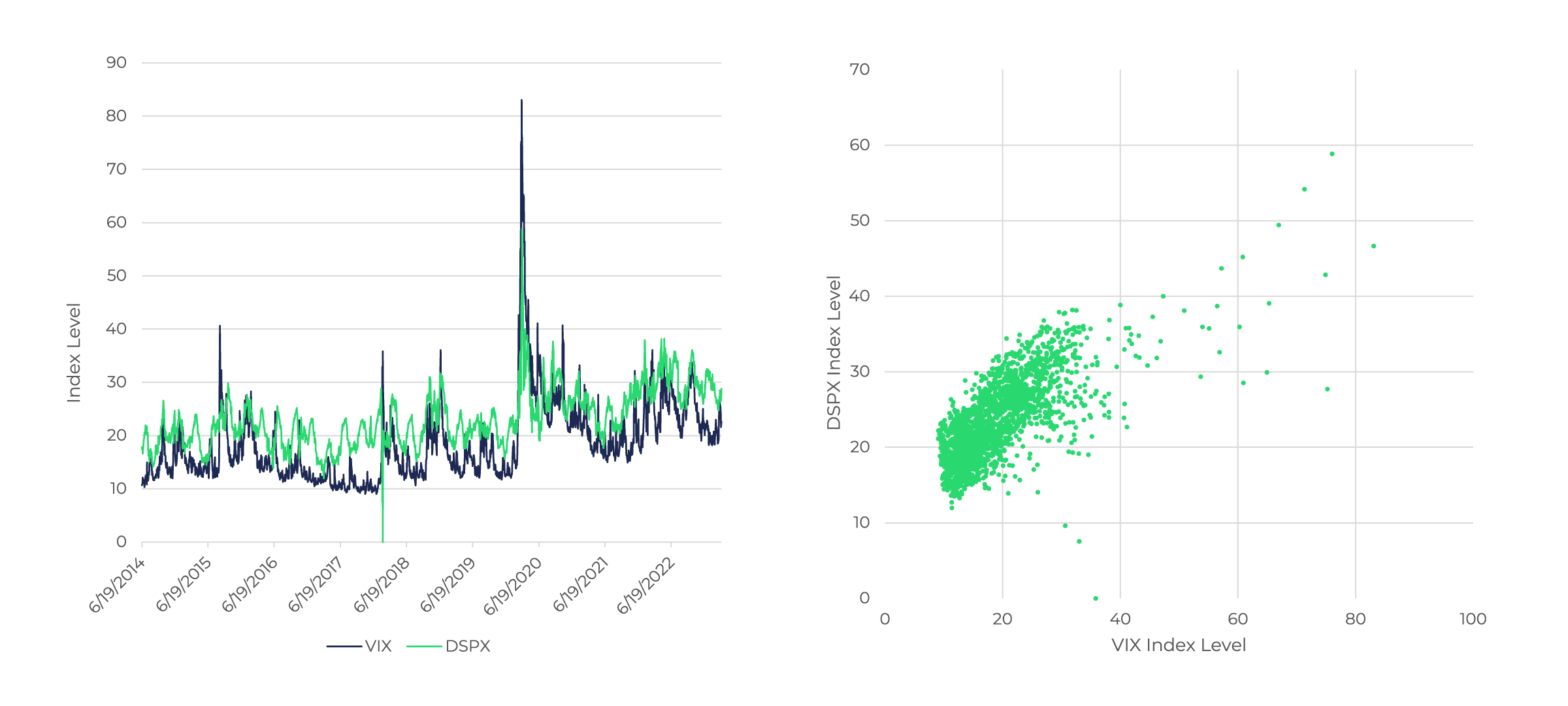

Based on the methodology alone, all else being equal, if the VIX Index rises, the Dispersion Index would be expected to decline. However, all else is not typically equal: when S&P 500 index volatility rises, the volatility of S&P 500 constituents typically also increases, and if the market expectations for single stock variances rise more than the expectations for index variance, then the Dispersion Index would be expected to increase together with the VIX Index. Empirically, this has frequently been the case, as the next Exhibit demonstrates.

Based on the live history of the VIX Index and the hypothetical historical levels of the Dispersion Index, over the full period for which data are available, the below Exhibit plots a time-series and scatter plot comparison over the two series. Although clearly distinct, the two series follow similar trends over time and their absolute levels are positively correlated.

Exhibit: Comparison of the VIX Index levels with the Dispersion Index

Resources to Learn More

Cboe S&P 500 Dispersion Index Methodology Cboe S&P 500 Dispersion Basket Index Methodology

Index Data

Links

The Cboe Global Indices Feed is a market data service provided by Cboe Global Markets that delivers real-time index values on more than 1,500 products, including DSPX. Featured values from Cboe include SPX® and the VIX® as well as indices from Morningstar, Standard & Poor's/Dow Jones, FTSE Russell, Ameribor, CoinRoutes RealPrice, Gemini, MSCI, Societe Generale and others.

The information in this webpage is provided for general education and information purposes only. No statement(s) within this webpage should be construed as a recommendation to buy or sell a security [or futures contract, as applicable] or to provide investment advice. Supporting documentation for any claims, comparisons, statistics or other technical data in this webpage is available by contacting Cboe Global Markets at www.cboe.com/Contact. Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of “Characteristics and Risks of Standardized Options.” Copies are available from your broker or from The Options Clearing Corporation at 125 South Franklin Street, Suite 1200, Chicago, IL 60606 or at www.theocc.com. Past Performance is not indicative of future results. “Cboe” is a registered trademark and is a service mark of Cboe Exchange, Inc. All other trademarks and service marks are property of their respective owners. © 2023 Cboe Exchange, Inc. All Rights Reserved.