Read More

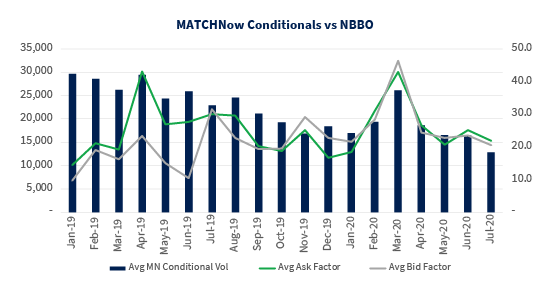

The Canadian equity trading landscape has evolved over the past decade, leading to the rise of dark pools, inverted venues, minimum guaranteed fill facilities and asymmetrical speed bumps. Client demand and the difficulty in sourcing blocks within a fragmented marketplace led MATCHNow to launch Conditional Trading in January 2019. Firms up rates in the high 90% range coupled with the inherent cost savings of a midpoint block are proving to be valuable factors in reducing overall trading costs for the street.

Size Matters

MATCHNow tailored the Conditional Order Book to meet the needs of the block trader via large minimum trade sizes. Orders must be a minimum of 50 standard trading units or $100,000 notional. Average trade sizes are much larger than the required minimums and are 14 to 45 times larger than the indicated size at the NBBO. In addition, when executing conditionally on MATCHNow, there is a 92.5% chance that the trade will be in the top one percentile by size, on an ex-cross basis.

Blocks at the Midpoint Matter

By sourcing midpoint blocks, the trader will leave a smaller footprint in the marketplace and won't cross spread. This leads to overall lower trading costs, especially for illiquid securities.

Midpoint Savings

The below chart* visualizes historical average spreads in Canada.

*Courtesy of RBC Capital Markets

Back of the envelope math indicates that on spread alone, a MATCHNow conditional print can save between 2.5 to 30 basis points versus crossing spread for liquidity.

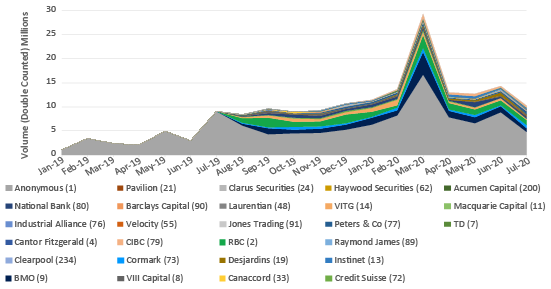

As volatility spiked and spreads widened in March, brokers that were connected to the Conditional Book were able to source unique liquidity. Currently, 26 brokers leverage 7 different service providers.

Block Savings

In its 2017 research paper, Cowen and Co. analyzed proprietary data and assigned a basis point savings rate to conditional blocks. Their findings suggest the value of a block is at least 6 bps. Additionally, although MATCHNow trades a significant portion of its conditional volume in the most liquid securities, as shown in the table below, the Cowen paper suggests that as the average daily volume (ADV) of a security decreases, the value of the block increases, meaning significant cost savings may be realized for the 37% of conditional trades that MATCHNow executes in less liquid securities.

Quick Links