Cboe Hanweck

Your Risk, Managed: Real-Time

Cboe Hanweck is a leading provider of margin-risk analytics with a real-time, data-enabled, global, cross-asset, risk-analytics platform. Cboe Hanweck is part of Cboe's Data and Access Solutions, which offers a comprehensive and holistic array of data, analytics, and execution services for each stage in the lifecycle of a transaction. From pre-trade, to at-trade, to post-trade, these solutions deliver insights, alpha opportunities, portfolio optimizations and seamless workflows.

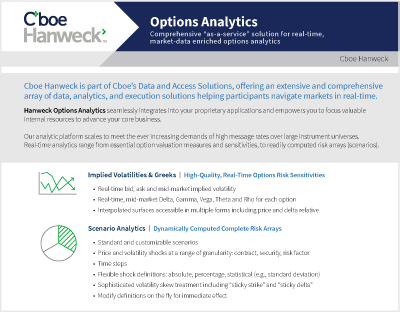

Options Analytics

Cboe Hanweck Options Analytics is your “as-a-service” solution for real-time, data-enabled, global and cross-asset risk analytics.

Learn MorePortfolio & Margin Analytics

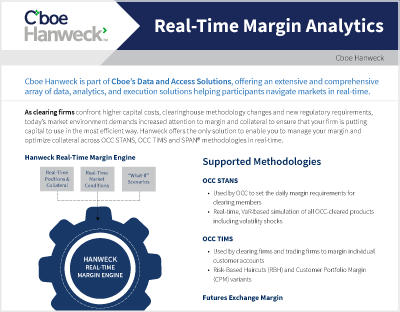

Portfolio & Margin Analytics builds upon our Options Analytics platform to offer a real-time, “portfolio aware” solution for risk management. Deploy our quant finance expertise to help your firm manage risks and lower costs.

Learn MoreTrading Indicators

Trading Indicators deliver a unique set of derived analytics, mining data from the options markets as a rich source for market expectations. These real-time indicators can inform trading and risk decisions beyond options trading.

Learn MoreHistorical Data

Cboe offers a rich and comprehensive dataset of historical market and analytic data. The platform manages over 3 petabytes of data that has great depth and granularity.

Learn MoreWhy Cboe Hanweck?

Real-Time Processing

The Volera® Engine’s hardware-accelerated technology is capable of consuming the highest-volume market data feeds in real-time (e.g., the OPRA feed with peaks around 90 million messages per second) and processing millions of analytical calculations per second.

Fully Customizable

Clients can modify inputs, assumptions, and obtain custom models to align with their needs and ensure relevant and readily consumable data.

Data-Enabled Approach

Market data feeds and critical reference data are unified in our data environment, creating a high-quality integrated data product that streamlines your workflow and reduces overall costs.

Effective Resource Allocation

Our cost effective “as-a-service" model allows customers to redirect internal resources to higher impact efforts.

Product Scope

Frequency

Real-time, intraday intervals, and end-of-day full tick recaps and time interval summaries.

Delivery

API, deployed instance, intraday file delivery, relational database, Multicast via cross-connect at major co-location centers including NY4, CH2, LD4 and AM1 (coming soon).

Coverage

All major exchanges across North America and Europe, listed equity options and futures, and Tick-level, up-to-the-millisecond pricing

Use Cases

Retail Brokers

- Perform intraday margin calculations to ensure that large customer accounts do not exceed trading limits on days with high market volatility.

- Provide professional-level implied volatilities, Greeks, and theoretical values down to the retail level.

- Add value through access to premiere, real-time options analytics.

Prime Brokers

- Use real-time analytic data to perform pre-trade risk checks, including Rule 15c3-5 compliance requirements.

- Perform post-trade risk checks, intraday margin and other portfolio risk calculations with full real-time risk analytics.

- Keep sales traders informed for all customer conversations.

- Add value by white-labeling real-time risk analytics and providing them directly to your customer base.

Asset Managers

- Integrate the highest quality implied volatilities, Greeks, and theoretical values into your workflow to make better trading decisions.

- Perform exchange and house margin calculations in real-time to manage pre- and post-trade risk and anticipate end-of-day clearinghouse requirements.

- Conduct scenario analysis to test P&L impact in real-time.

- Employ valuable signal data derived from the options markets to inform equity and credit trading strategies.

Risk and Compliance

- Use real-time data to perform pre-trade risk checks, including Rule 15c3-5 compliance requirements and “fat finger” checks.

- Perform post-trade risk checks, intraday margin and other portfolio risk calculations with full real-time risk analytics.

- Conduct scenario analysis to test how changes in price, volatility, and the passage of time will impact P&L.

CCPs

- Perform margin calculations in real-time for continuous risk monitoring.

- Accurately track counterparty risk of market participants with real-time analytics and position data.

EMS / OMS / ISVs

- Offer comprehensive implied volatilities, Greeks, and theoretical values to your customer base.

- Include charting and historical data streams to enhance current offering.