Data Analytics and Indices

Trending

Build Trusted Markets with Accessible Data

In today’s markets every second counts and decisions are made in the blink of an eye, and accessible market data is more essential than ever. Trusted, accessible market data plays a pivotal role in empowering investors, driving transparency and fostering confidence in the financial markets.

Read MoreIn today’s markets every second counts and decisions are made in the blink of an eye, and accessible market data is more essential than ever. Trusted, accessible market data plays a pivotal role in empowering investors, driving transparency and fostering confidence in the financial markets.

Empowering Investors

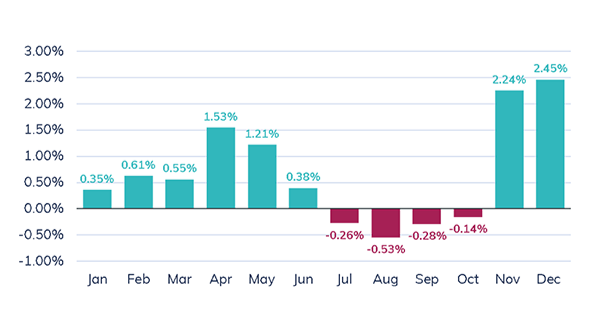

First and foremost, accessible market data empowers investors of all types, from major institutions to individual traders. By providing real-time pricing information, historical data and insightful analytics, market data enables investors to make informed decisions quickly and confidently. Whether it's assessing market volatility, identifying trading opportunities, or adjusting investment strategies, reliable data is indispensable, and it should be accessible to investors of all kinds.

That said, data should be as reliable as it is accessible. In a world of misinformation, trustworthy market data is increasingly important. When market participants know they can count on the data they are receiving, they can act quickly and do not have to spend additional time validating information.

Likewise, transparency is fundamental to the integrity of financial markets and accessible market data helps promote fair competition. It also builds trust among investors, which is essential to a well-functioning economy and helps provide a broad understanding of investor sentiment, another important factor in understanding the pulse of the economy.

Navigating Global Complexity

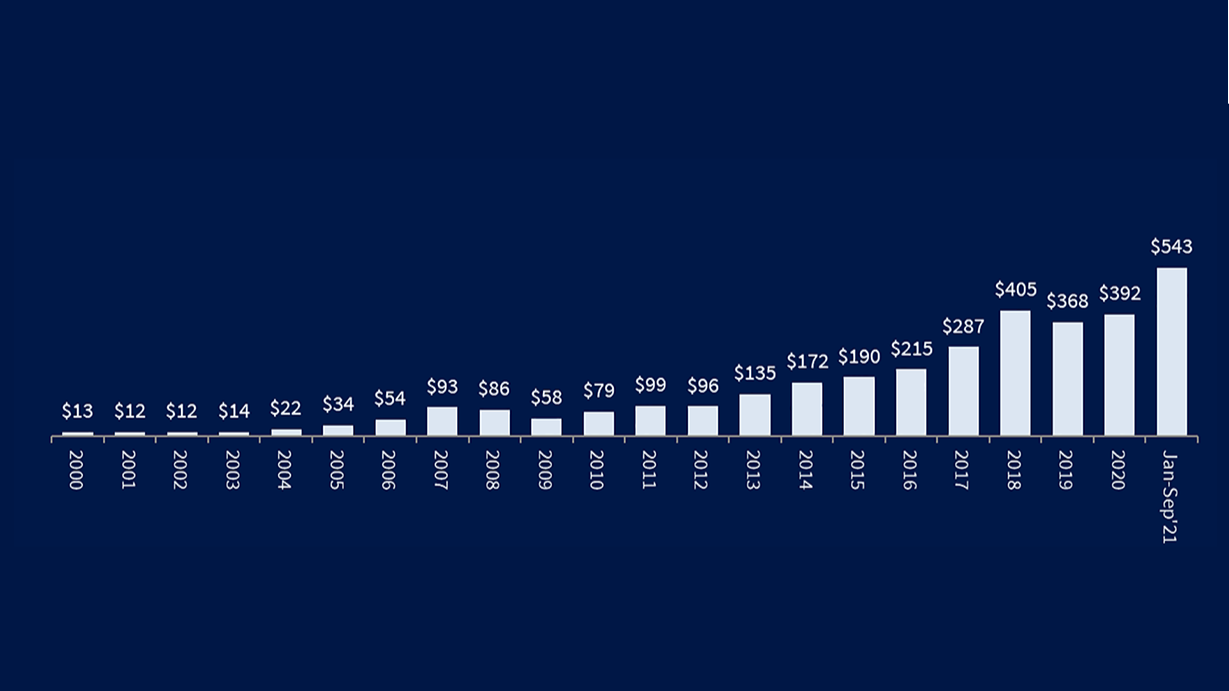

We live in an increasingly globally connected world, and as a result markets worldwide are inextricably linked, which means people need more data about more markets than they once did. Accessible market data provides insights into international trends, currency fluctuations and how geopolitical developments are impacting financial markets worldwide. Investors want global market data to inform their investment decisions, even if they are not investing in foreign markets. Additionally, they may very well be investing in foreign markets and need data to stay apprised of the environment abroad. More than 60 percent of the users taking Cboe Global Cloud’s U.S. market data feed are based outside the U.S. This shows us how people may be interacting with the global markets and helps us consider potential customer needs.

Education

Accessible market data can be an incredibly valuable educational tool for people who are new to investing. Through data-driven analysis and research, novice investors gain deeper insights into market dynamics, economic trends and industry performance that help shape their understanding before they begin deploying their capital. Making this data easily accessible is crucial to helping more people become market participants and ensuring that they are well-informed market participants from the start.

At Cboe, we believe accessible, quality data is the lynchpin of a fair, efficient and resilient ecosystem. Our goal is to embrace transparency and empower investors with reliable, accessible data, analytics and indices.

Want to receive these notes in your inbox? Subscribe here.

The information provided is for general education and information purposes only. No statement provided should be construed as a recommendation to buy or sell a security, future, financial instrument, investment fund, or other investment product (collectively, a “financial product”), or to provide investment advice. © 2024 Cboe Exchange, Inc. All Rights Reserved