Dawn of a New Era Brings on the Existence of Skew

The End of History

Francis Fukuyama’s The End of History was published in 1989, just before the fall of the Berlin Wall on November 9. That event signaled the end of the Soviet Union, the end of the Cold War era, and the beginning of something new. A new global order emerged. Fukuyama described that point as “not just the passing of a particular period of post-war history, but the end of history as such.”

A similar cataclysmic event occurred two years prior. October 19, 1987 came to be known as Black Monday. That session marked the end of history in option markets and the dawn of a new era, an age defined by the existence of skew.

How It Was…

Broad-based index options (OEX options and SPX options) were introduced by Cboe in 1983. For the first four years of index option trading there was almost no observable skew embedded in the market (new to skew? Check out this week’s Simply Put below). In other words, 5% out-of-the-money (OTM) SPX or OEX calls would trade for roughly the same premium as the 5% OTM puts with the same expiry. Alternatively, equidistant OTM options traded with nearly identical implied volatilities.

From a normal distribution standpoint, that makes sense. Gaussian distributions are symmetrical from the mean value, and the most common visual associated with this distribution is a bell curve.

Bell Curve Distribution

Option values reflect the probability of a given outcome over a specific time frame. If you assume a normal distribution, there is zero skew embedded. In the example above, this model assumes the probability of moving from 69 (the mean) to 53 or 85 is identical.

Transposed into the options marketplace, and assuming normal distribution, the price of a 53-strike put, and an 85-strike call would be same.

Models are incredibly valuable, but no model is infallible. The events of October 19, 1987 forced option traders to reevaluate their assumptions.

Here you can visualize alternative distribution models. The blue and green examples exhibit skewness whereas the “normal” distribution (red) has no skew.

Bell Curve Distribution with Positive and Negative Skewness

History & Assumptions

Our assumptions about future outcomes are typically informed by historical events. Prior to 1987, the largest single session decline in the S&P 500 Index was just over 12%. Excluding the Great Depression era (1929 – late 1930’s), the largest decline in the index was 7.5% in March of 1940.

If we look at the largest single day declines (annually) in the S&P 500 Index between 1950 and 1986, the average comes to -2.72%. If we evaluate the data for 1987-2020, the average works out to -4.57%. That’s a significant difference despite the sample sizes being very similar (36 years v. 33 years).

If we exclude 1987 from our calculation, the average for 1988-2020 drops to -4.08%. If we exclude both 1987 and 2020, the average declines further to -3.84%. The key takeaway here is, the broad market has had more volatile sessions over the past three decades relative to the previous thirty plus year period.

That data matters to anyone pricing/utilizing options. The historical average daily change in the S&P 500 Index is +/-0.74%. A daily change of +/-3% would represent a multiple standard deviation change. Options have embedded convexity, so long option exposure in those situations can be very beneficial.

Perhaps as the cash and derivatives markets evolved, they have become more efficient at repricing risk. Single session declines of 3+% are uncommon, but as Nassim Taleb states, “the inability to predict outliers implies the inability to predict the course of history” (The Black Swan: The Impact of the Highly Improbable).

The option markets give us probabilities, not certainty. Option deltas can double as the current probability for expiring in-the-money (ITM), all else constant. The extent to which market demand for downside protection exceeds upside exposure is emblematic of the perception of outlier (left tail) events. Understanding the supply and demand dynamics is crucial to understanding skew.

S&P 500 Index Largest Percentage Drop

Supply & Demand

Markets and prices are driven by supply and demand and the index options marketplace is no different. Let’s consider the prevailing supply/demand dynamic for S&P 500 options. The demand side of the ledger is broad and varied. Buyers of index options come in all forms from individual to institutional traders. Most are motivated by the desire to limit their portfolio risk for a defined time frame.

Consider the fact that most market participants are “passive long.” They are exposed to fluctuations in the market via 401k holdings, defined benefit plans, or taxable investment accounts. These accounts own assets, meaning they are long the market. As such, market participants benefit from equity prices (and the indices that track them) moving higher over time. These participants’ risk is exclusively to the downside.

To the extent that “water cooler” talk occurs these days, someone is much more likely to express concern following a 2% down day for the S&P 500 as opposed to a 2% up day. There is an estimated $13.5 trillion in assets benchmarked to the S&P 500. A 2% decline from $13.5T is a collective loss of about $270 billion.

Here’s some context for that figure. The 2021 global GDP estimate, or value of all goods and services bought/sold in the world, comes to $92 trillion. The U.S. takes the top position with $20.5T in GDP. China is second with $13.4T.

The amount of capital benchmarked to the S&P 500 is roughly equivalent to the annual GDP of China.

Demand

With that in mind, a huge pool of natural buyers of S&P 500 downside protection (puts) exists. These people and institutions benefit from markets moving higher and look to insulate their assets in the event of declines. Furthermore, market participants are often willing to finance the cost – premium – of that protection – put – by giving up some potential upside, like selling calls.

Supply

Who supplies the market? More specifically, who is willing to sell OTM S&P 500 puts and purchase OTM calls? The supply side is sizeable, but narrower. The primary suppliers are well capitalized trading firms that act as market makers. Dealers like large banks are also a significant player in the listed index options market.

Market makers and dealers are especially cognizant of the fact that markets tend to move down with greater velocity then when they move higher. They also know that there is unequal, or skewed, demand for OTM puts and supply of OTM calls.

The supply side of the market altered their models or probability assumptions following October 19, 1987. The updated perceptions of unequal tail risk are now omnipresent.

Relationships

When relationships are discussed in capital markets, it’s typically an evaluation of one asset or index in relation to another. Correlation measures the extent that two assets move in relation to one another.

In math, division is one of the simplest ways to compare figures. For example, what’s the relationship between the price of a pound of grapefruit to a pound of navel oranges? They are similar products, both citrus fruits. Well, we can figure that out with the help of data from the USDA.

The USDA provides a numerator, in this case the average price for a pound of grapefruit, from which we can deduce the 2019 average of $1.34525 per pound of grapefruit.

We also source a denominator from the USDA. The average price for a pound of navel oranges in 2019 works out to $1.255769.

What’s the relationship between grapefruit and navel oranges? On average, grapefruit is more expensive. To what degree? $1.34525/$1.255769 = 1.071256.

On average, a pound of grapefruit is 7.1256% more expensive than a pound of navel oranges.

Similarly, there is an established relationship between OTM index options with the same maturity. An evaluation of prices and/or implied volatilities for options struck 2+ standard deviations from the mean illuminates the degree to which the market demands relative to the upside tail exposure.

SKEW in SPX

The Cboe SKEW IndexSM (SKEW Index ) Index quantifies the relationship between two similar products. The SKEW Index measures the difference in prices (influenced by IV levels) between a portfolio of OTM S&P 500 Index options. The index calculation is more complex than simple division, but you can find the full methodology in Cboe’s SKEW White Paper from 2011.

Ultimately, the SKEW Index is a quantified expression of the relationship between at- and out-of-the-money SPX options, specifically a measurement of the difference in price between OTM SPX call options and OTM SPX put options.

Since 1987’s Black Monday market participants have been willing to pay more for downside protection relative to equidistant OTM upside exposure.

Using the framework laid out in our grapefruit and orange example, we could compare a 5% OTM SPX put and call options that expire in 29 calendar days (November 10, 2021).

- SPX reference: 4360

- 5% OTM call = ~4575 strike = 3.55 (midpoint)

- 5% OTM put = ~4150 strike = 31.65 (midpoint)

As you can see in this example, the price of a 5% OTM is almost 900% more expensive in dollar terms relative to a 5% OTM call with the same expiry. The IV for the OTM put is ~22% and the call is 11.25%.

The index option marketplace is generally skewed to the downside.

So What…

Here’s a look at the performance of the S&P 500 Index (red/white Barchart) and Cboe’s SKEW Index (green) over the past two years. We’ve highlighted three of the larger drawdown periods for the S&P 500. You’ll notice the tendency for the SKEW Index to decline alongside the S&P 500.

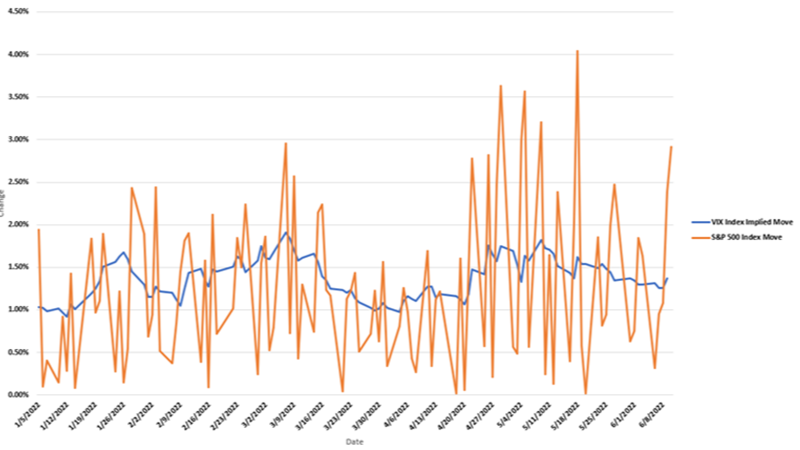

When the S&P 500 falls a few things typically occur in the index options marketplace. Generally, at-the-money (ATM) implied volatility levels increase. The VIX Index usually moves higher.

S&P 500 Index and Cboe SKEW Index

Referencing the SKEW White Paper, there’s a historical relationship between the Cboe Volatility Index® (VIX® Index) and the SKEW Index. Namely, there’s a tendency for higher SKEW Index measures in a lower VIX Index environment. The SKEW Index tends to fall when the VIX Index rises. That likelihood follows logically from the previous example of the SKEW Index often declining when the S&P 500 Index falls. The VIX Index typically rises when the broad market sells off.

S&P 500 Index Implied Volatility SKEW Index

Here & Now

Over the past few weeks, the SKEW Index has declined as the market sold off. The VIX Index moved from around 15.5 in early September to roughly 20 as of mid-month. ATM 30-day SPX option implied volatilities have moved from ~11% to ~19.5%. That’s +7.5 vols or a 68% jump in ATM vols.

In that situation, you don’t see an equivalent increase in OTM options. The combination of a shift to a lower S&P 500 Index (price) level, a higher VIX Index level, higher ATM vols, and a lower SKEW Index level is typical. The volatility skew flattens.

Christopher Jacobsen of Susquehanna plots the change in the SPX skew by comparing mid-May to early October. You can see how both tails (OTM calls and puts) have declined in volatility terms.

SPX Skew Comparison of Mid-May to Early October 2021

Synthesizing Data Points

Earlier this year, many market pundits focused attention on the fact that Cboe’s SKEW Index made new all-time highs. Understanding why an index like the SKEW Index moves higher or lower is valuable. Synthesizing multiple data points provides a more insightful interpretation of the landscape and stronger decision-making.

There’s arguably been a more pronounced supply/demand imbalance in the index options market since March of last year. It’s possible that losses stemming from short volatility trading – selling OTM SPX options – forced some supply out of the market. Other market participants were likely compelled to reduce their net exposure post March 2020.

The demand for OTM puts remains strong as the market experienced the most violent 30% drawdown ever. $13.5 trillion in assets are still benchmarked to the S&P 500 Index so the bid for protection stands to reason.

Then the market surged and demand for OTM call options skyrocketed. This behavior was more apparent in individual equity options, but there was a knock-on effect in OTM SPX calls. Both the left tail (downside) and right tail (upside) options were in demand.

The marketplace no longer assumes a “normal distribution.” Historical events can change everything, and skew has been omnipresent in the index options market for 34 years. History “ended” and began anew on October 19, 1987.

The SKEW Index is one data point that illuminates the relationship between OTM index options in price/volatility terms. It can be combined with an understanding of the VIX Index for a more thorough view of the derivatives outlook.

To learn more about volatility and how to use it in your portfolio, we welcome you to register for one of The Options Institute’s upcoming webinars. See you there.

Industry News

- TD Ameritrade Network: Cboe’s Henry Schwartz Recapping 3Q21's Option Market Takeaways

- Interactive Brokers’ Traders Insights: Volatility is Back

- Interactive Brokers’ Traders Insights: We Go Down One Day, Up the Next. This is Volatility

- Bloomberg: Equities Storm Looking Overblown as Volatility Gauge Stays Calm

- The Wall Street Journal: Risky Volatility Funds Set to Make a Comeback

Events

- October 21: Cboe's Kevin Davitt featured on the e S&P DJI Weekly Index Strategy Update Call

- October 26: Back to School Series: Volatility Spreads - Part 1

- October 27: Put-writing and Portfolio Risk Management

- November 3: Retail Trends: Uses of Delta and Gamma in Options Strategies

Volatility411

Get the Inside Volatility Trading newsletter directly in your inbox by signing up here.

General

- The information provided is for general education and information purposes only. No statement provided should be construed as a recommendation to buy or sell a security, future, financial instrument, investment fund, or other investment product (collectively, a “financial product”), or to provide investment advice.

- In particular, the inclusion of a security or other instrument within an index is not a recommendation to buy, sell, or hold that security or any other instrument, nor should it be considered investment advice.

Options

- Options involve risk and are not suitable for all market participants. Prior to buying or selling an option, a person should review the Characteristics and Risks of Standardized Options (ODD), which is required to be provided to all such persons. Copies of the ODD are available from your broker or from The Options Clearing Corporation, 125 S. Franklin Street, Suite 1200, Chicago, IL 60606.

- Trading FLEX options may not be suitable for all options-qualified market participants. FLEX options strategies only should be considered by those with extensive prior options trading experience.

- Uncovered option writing is suitable only for the knowledgeable market participant who understands the risks, has the financial capacity and willingness to incur potentially substantial losses, and has sufficient liquid assets to meet applicable margin requirements. In this regard, if the value of the underlying instrument moves against an uncovered writer's options position, the writer may incur large losses in that options position and the participant’s broker may require significant additional margin payments. If a market participant does not make those margin payments, the broker may liquidate positions in the market participant’s account with little or no prior notice in accordance with the market participant’s margin agreement.

Futures

- Futures trading is not suitable for all market participants and involves the risk of loss, which can be substantial and can exceed the amount of money deposited for a futures position. You should, therefore, carefully consider whether futures trading is suitable for you in light of your circumstances and financial resources. You should put at risk only funds that you can afford to lose without affecting your lifestyle.

- For additional information regarding the risks associated with trading futures and security futures, see respectively the Risk Disclosure Statement set forth in Appendix A to CFTC Regulation 1.55(c) and the Risk Disclosure Statement for Security Futures Contracts.

VIX® Index and VIX® Index Products

- The Cboe Volatility Index® (known as the VIX Index) is calculated and administered by Cboe Global Indices, LLC. The VIX Index is a financial benchmark designed to be a market estimate of expected volatility of the S&P 500® Index, and is calculated using the midpoint of quotes of certain S&P 500 Index options as further described in the methodology, rules and other information here.

- VIX futures and Mini VIX futures, traded on Cboe Futures Exchange, LLC, and VIX options, traded on Cboe Options Exchange, Inc. (collectively, “VIX® Index Products”), are based on the VIX Index. VIX Index Products are complicated financial products only suitable for sophisticated market participants.

- Transacting in VIX Index Products involves the risk of loss, which can be substantial and can exceed the amount of money deposited for a VIX Index Product position (except when buying options on VIX Index Products, in which case the potential loss is limited to the purchase price of the options).

- Market participants should put at risk only funds that they can afford to lose without affecting their lifestyles.

- Before transacting in VIX Index Products, market participants should fully inform themselves about the VIX Index and the characteristics and risks of VIX Index Products, including those described here. Market participants also should make sure they understand the product specifications for VIX Index Products (VIX futures, Mini VIX futures and VIX options) and the methodologies for calculating the underlying VIX Index and the settlement values for VIX Index Products. Answers to questions frequently asked about VIX Index products and how they are settled is available here.

- Not Buy and Hold Investment: VIX Index Products are not suitable to buy and hold because:

- On their settlement date, VIX Index Products convert into a right to receive or an obligation to pay cash.

- The VIX Index generally tends to revert to or near its long-term average, rather than increase or decrease over the long term.

- Volatility: The VIX Index is subject to greater percentage swings in a short period of time than is typical for stocks or stock indices, including the S&P 500 Index.

- Expected Relationships: Expected relationships with other financial indicators or financial products may not hold. In particular:

- Although the VIX Index generally tends to be negatively correlated with the S&P 500 Index – such that one tends to move upward when the other moves downward and vice versa – that relationship is not always maintained.

- The prices for the nearest expiration of a VIX Index Product generally tend to move in relationship with movements in the VIX Index. However, this relationship may be undercut, depending on, for example, the amount of time to expiration for the VIX Index Product and on supply and demand in the market for that product.

- Mini VIX futures contracts trade separately from regular-sized VIX futures, so the prices and quotations for Mini VIX futures and regular-sized VIX futures may differ because of, for example, possible differences in the liquidity of those markets.

- Final settlement Value: The method for calculating the final settlement value of a VIX Index Product is different from the method for calculating the VIX Index at times other than settlement, so there can be a divergence between the final settlement value of a VIX Index Product and the VIX Index value immediately before or after settlement. (See the SOQ Auction Information section here for additional information.)

Exchange Traded Products (“ETPs”)

- Cboe does not endorse or sell any ETP or other financial product, including those investment products that are or may be based on a Cboe index or methodology or on a non-Cboe index that is based on investment products trading on a Cboe Company exchange (e.g., VIX futures); and Cboe makes no representations regarding the advisability of investing in such products. An investor should consider the investment objectives, risks, charges, and expenses of these products carefully before investing. Investors also should carefully review the information provided in the prospectuses for these products.

- Investments in ETPs involve risk, including the possible loss of principal, and are not appropriate for all investors. Non-traditional ETPs, including leveraged and inverse ETPs, pose additional risks and can result in magnified gains or losses in an investment. Specific risks relating to investment in an ETP are outlined in the fund prospectus and may include concentration risk, correlation risk, counterparty risk, credit risk, market risk, interest rate risk, volatility risk, tracking error risk, among others. Investors should consult with their tax advisors to determine how the profit and loss on any particular investment strategy will be taxed.

Cboe Strategy Benchmark Indices

- Cboe Strategy Benchmark Indices are calculated and administered by Cboe Global Indices, LLC as described in the methodologies, rules and other information available here using information believed to be reliable, including market data from exchanges owned and operated by other Cboe Companies.

- Strategy Benchmark Indices are designed to measure the performance of hypothetical portfolios comprised of one or more derivative instruments and other assets used as collateral. Past performance is not indicative of future results. Strategy Benchmark Indices are not financial products that can be invested in directly, but can be used as the basis for financial products or managing portfolios.

- The actual performance of financial products such as mutual funds or managed accounts can differ significantly from the performance of the underlying index due to execution timing, market disruptions, lack of liquidity, brokerage expenses, transaction costs, tax consequences and other considerations that may not be applicable to the subject index.

Index and Benchmark Values Prior to Launch Date

- Index and benchmark values for the period prior to an index’s launch date are calculated by a theoretical approach involving back-testing historical data in accordance with the methodology in place on the launch date (unless otherwise stated). A limitation of back-testing is that it reflects the theoretical application of the index or benchmark methodology and selection of the index’s constituents in hindsight. Back-testing may not result in performance commensurate with prospective application of a methodology, especially during periods of high economic stress in which adjustments might be made. No back-tested approach can completely account for the impact of decisions that might have been made if calculations were made at the same time as the underlying market conditions occurred. There are numerous factors related to markets that cannot be, and have not been, accounted for in the preparation of back-tested index and benchmark information.

Taxes

- No Cboe Company is an investment adviser or tax advisor, and no representation is made regarding the advisability or tax consequences of investing in, holding or selling any financial product. A decision to invest in, hold or sell any financial product should not be made in reliance on any of the statements or information provided. Market participants are advised to make an investment in, hold or sell any financial product only after carefully considering the associated risks and tax consequences, including information detailed in any offering memorandum or similar document prepared by or on behalf of the issuer of the financial product, with the advice of a qualified professional investment adviser and tax advisor.

- Under section 1256 of the Tax Code, profit and loss on transactions in certain exchange-traded options and futures are entitled to be taxed at a rate equal to 60% long-term and 40% short-term capital gain or loss, provided that the market participants involved and the strategy employed satisfy the criteria of the Tax Code. Market participants should consult with their tax advisors to determine how the profit and loss on any particular option or futures strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations.

General

- Past performance of an index or financial product is not indicative of future results.

- Brokerage firms may require customers to post higher margins than any minimum margins specified.

- No data, values or other content contained in this document (including without limitation, index values or information, ratings, credit-related analyses and data, research, valuations, strategies, methodologies and models) or any part thereof may be modified, reverse-engineered, reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of Cboe.

- Cboe does not guarantee the accuracy, completeness, or timeliness of the information provided. THE CONTENT IS PROVIDED “AS IS” WITHOUT WARRANTY OF ANY KIND, EITHER EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY WITH RESPECT MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE.

- Hypothetical scenarios are provided for illustrative purposes only. The actual performance of financial products can differ significantly from the performance of a hypothetical scenario due to execution timing, market disruptions, lack of liquidity, brokerage expenses, transaction costs, tax consequences and other considerations that may not be applicable to the hypothetical scenario.

- Supporting documentation for statements, comparisons, statistics or other technical data provided is available by contacting Cboe Global Markets at www.cboe.com/Contact.

- The views of any third-party speakers or third-party materials are their own and do not necessarily represent the views of any Cboe Company. That content should not be construed as an endorsement or an indication by Cboe of the value of any non-Cboe financial product or service described.

Trademarks and Intellectual Property

- Cboe®, Cboe Global Markets®, Bats®, BIDS Trading®, BYX®, BZX®, Cboe Options Institute®, Cboe Vest®, Cboe Volatility Index®, CFE®, EDGA®, EDGX®, Hybrid®, LiveVol®, Silexx® and VIX® are registered trademarks, and Cboe Futures ExchangeSM, C2SM, f(t)optionsSM, HanweckSM, and Trade AlertSM are service marks of Cboe Global Markets, Inc. and its subsidiaries. Standard & Poor's®, S&P®, S&P 100®, S&P 500® and SPX® are registered trademarks of Standard & Poor's Financial Services LLC and have been licensed for use by Cboe Exchange, Inc. Dow Jones®, Dow Jones Industrial Average®, DJIA® and Dow Jones Global Indexes® are registered trademarks or service marks of Dow Jones Trademark Holdings, LLC, used under license. Russell, Russell 1000®, Russell 2000®, Russell 3000® and Russell MidCap® names are registered trademarks of Frank Russell Company, used under license. FTSE® and the FTSE indices are trademarks and service marks of FTSE International Limited, used under license. MSCI and the MSCI index names are service marks of MSCI Inc. (“MSCI”) or its affiliates and have been licensed for use by Cboe. All other trademarks and service marks are the property of their respective owners.

Copyright

- © 2021 Cboe Exchange, Inc. All Rights Reserved.