Portfolio & Margin Analytics

Real-time, “portfolio aware” solutions for risk management.

Download Product Overview- Stress Tests

-

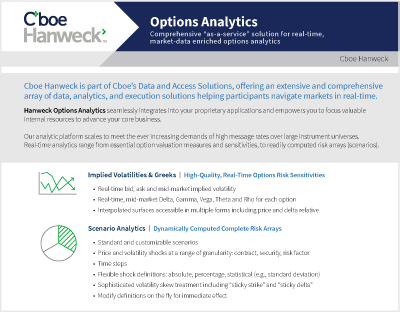

- P&L Vectors and Exposure Risk

- Volatility Surfaces

- Learn More

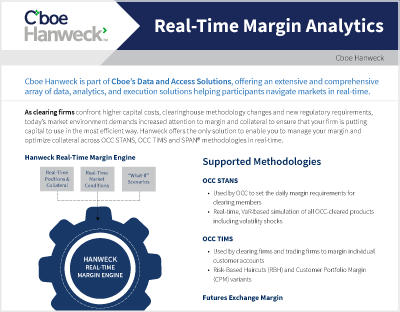

- Margin Engine for STANS® Methodology by OCC

-

- Real-Time OCC STANS® Methodology

- STANS® Collateral Optimization

- Learn More

- Portfolio Margin

-

- TIMS® Methodology by OCC and Enhanced TIMS® Methodology by OCC

- Margin Engine for STANS® Methodology

- Futures Exchange Margin

- Broker ("House") Margin

- Learn More

- Portfolio Risk

-

- Exposure Risk

- Scenario and Simulation

- Learn More

Why Cboe Hanweck?

Real-Time Processing

The Volera® Engine’s hardware-accelerated technology is capable of consuming the highest-volume market data feeds in real-time (e.g., the OPRA feed with peaks around 90 million messages per second) and processing millions of analytical calculations per second.

Fully Customizable

Clients can modify inputs, assumptions, and obtain custom models to align with their needs and ensure relevant and readily consumable data.

Data-Enabled Approach

Market data feeds and critical reference data are unified in our data environment, creating a high-quality integrated data product that streamlines your workflow and reduces overall costs.

Effective Resource Allocation

Our cost effective “as-a-service" model allows customers to redirect internal resources to higher impact efforts.

Case Studies

TIMS®, STANS®, and OCC® are registered trademarks of The Options Clearing Corporation ® (OCC). OCC assumes no liability in connection with the use of STANS or TIMS by any person or entity. The current version of TIMS or STANS may not be reflected in the Cboe Hanweck services described herein.