Global Markets

Tradable Products

Featured Products

Cboe Data Vantage

Analytics & Execution

Access Solutions

Indices

Other Solutions

Since 1983, Cboe has offered stock index options. In 2018, several new all-time records for volume and open interest were reported as investors faced heightened volatility. Index options have the potential to generate more income for options sellers who receive options premiums, help manage exposure and protect a portfolio from damaging huge drawdowns.

RECORD VOLUME AND OPEN INTEREST FOR CBOE’S S&P 500 OPTIONS

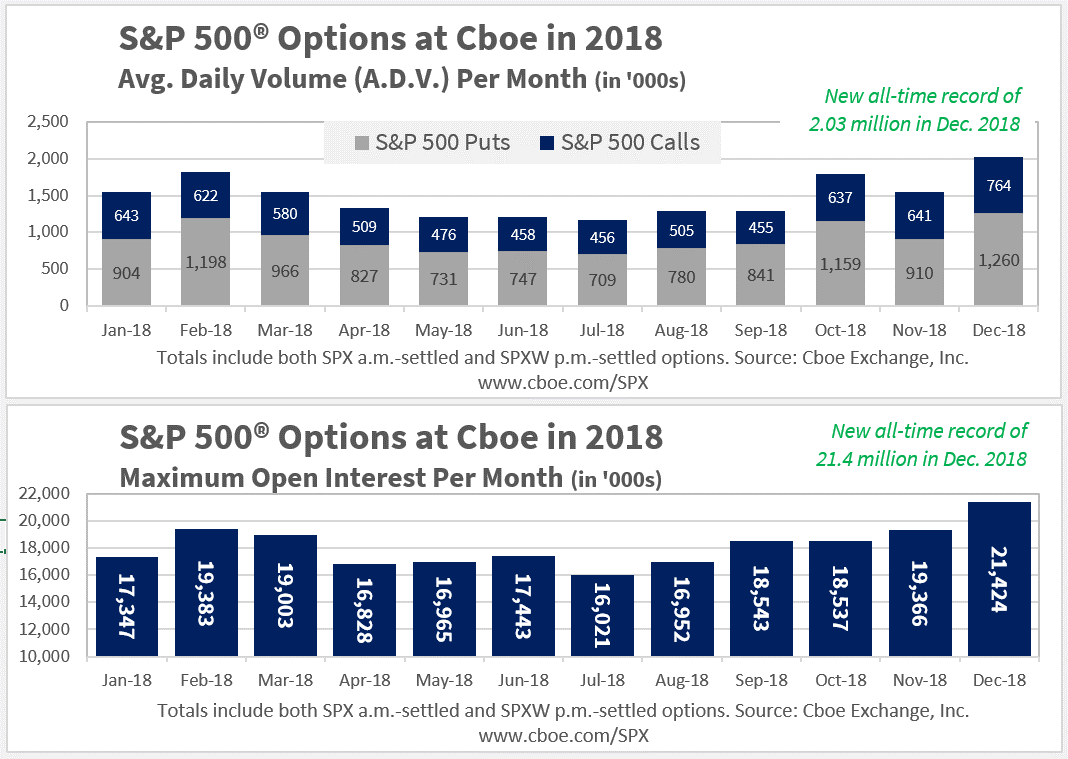

In 2018, the average daily volume (ADV) for S&P 500® options (SPXTM and SPXW) at Cboe rose 27% to a new record of 1.479 million contracts.

The month of December 2018 also saw new all-time records for Cboe’s S&P 500 options, as the monthly ADV surpassed 2 million contracts for the first time, and the maximum open interest topped 21 million contracts for the first time.

It is interesting to compare the two 2018 charts above with the two 2018 charts below. As volatility (and options premiums) picked up in February and December 2018, so did the volume and open interest for S&P 500 options.

RECORD MONTH FOR MINI-SPX (XSP) OPTIONS

In December 2018, Cboe’s Mini-SPX (XSP) options set a new all-time record of 30,035 ADV.

The Cboe Mini-SPX (XSP) is an index designed to track the underlying S&P 500 index. At 1/10 the size of the standard SPX options contract, Cboe’s XSP options offer traders the flexibility to implement their S&P 500 index option strategy, using a smaller contract size. The structure of the XSP options contract may provide many benefits over alternative options choices, including:

1. European exercise - No risk of early assignment;

2. Cash settlement - The trading account is credited/debited in cash, not ETF shares;

3. A mini contract size - A smaller contract size may provide more trading flexibility; and

4. Tax treatment - Check with your tax advisor on section 1256 of the tax code to determine if you're eligible for 60/40 tax treatment. Under section 1256 of the Tax Code, profit and loss on transactions in certain exchange-traded options, including SPX and XSP, are entitled to be taxed at a rate equal to 60% long-term and 40% short-term capital gain or loss, provided that the investor involved and the strategy employed satisfy the criteria of the Tax Code. Investors should consult with their tax advisors to determine how the profit and loss on any particular option strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations.

GLOBAL EXPOSURE AND RECORD MONTH FOR LARGE-SIZED MSCI MXEF AND MXEA OPTIONS AT CBOE

Investors who wish to explore large-sized cash-settled index tools that can help manage global equity risk are taking a look at CBOE’s large-sized, cash-settled options on the MSCI EAFE® Index (ticker MXEA) and on the MSCI Emerging Markets Index (ticker MXEF). In December 2018, new all-time records for total volume were established for both the MXEF options (27,493 contracts) and for the MXEA options (12,293 contracts).

MORE INFORMATION

To learn more about ways in which index options and volatility products can be used in portfolio management, please visit the below links: