Global Markets

Tradable Products

Featured Products

Cboe Data Vantage

Analytics & Execution

Access Solutions

Indices

Other Solutions

Cboe U.S. Treasuries

Cboe has innovated large order execution in FX—now we're applying that same proven technology to Treasury trading. Our Full Amount platform addresses typical execution challenges, delivering single-ticket fills with minimal market impact. The results speak for themselves: increasing trading volumes and rapid adoption since launch.

What makes this different:

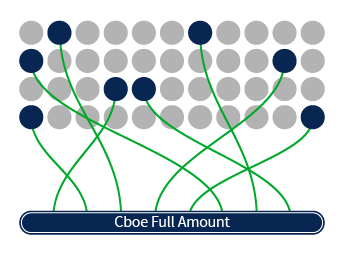

What Treasury traders have been waiting for. Cboe's Full Amount technology consolidates streaming quotes from premier dealers into single best prices at prescribed size levels. This proven approach from our FX platform delivers the efficiency and low market impact that traders expect for large order execution.

Cboe actively engages with Participants to construct and refine Full Amount liquidity pools based on quantitative and qualitative measures.

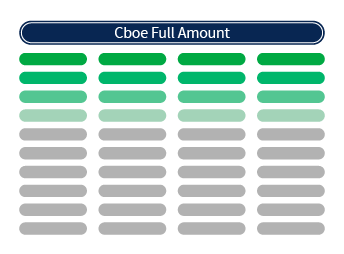

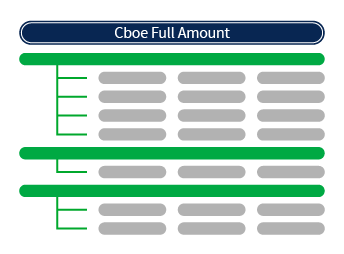

Liquidity consumers receive streaming top-of-book quotes across the on-the-run curve, in various sizes.

Configured liquidity providers continuously quote in prescribed sizes, filling aggressing Immediate-or-Cancel orders in a single-ticket.

Top of book prices are disseminated for each security and size via ITCH market data. Orders will never 'sweep' the market.

Cboe Fixed Income Markets, LLC ("Cboe Fixed Income") is a registered broker-dealer with the U.S. Securities and Exchange Commission, and is a member of the Financial Industry Regulatory Authority, Inc. (www.finra.org). Cboe Fixed Income does not provide services to retail customers.

Leverage Cboe's technology to anonymously distribute pricing with the assurance of being the full size of the incoming order.

Key benefits:

Transfer risk in size with efficiency and low market impact, while potentially earning price improvement on each trade.

Key benefits:

Whether you prefer direct connectivity or vendor relationships, we've designed seamless integration paths for market participants.

Access options:

Operational framework:

Cboe Fixed Income Operating Procedures

Cboe Fixed Income Application and Participant Agreement

Cboe Fixed Income Liquidity Provider Standards

Cboe Fixed Income Fee Schedule

Cboe Fixed Income Information

Cboe Fixed Income Connectivity Order Form

Cboe Fixed Income Connectivity and Session Price List

Cboe Fixed Income Connectivity Terms & Conditions

Cboe Fixed Income Reference Data

Cboe Fixed Income Markets, LLC ("Cboe Fixed Income") is a registered broker-dealer with the U.S. Securities and Exchange Commission, and is a member of the Financial Industry Regulatory Authority, Inc. (www.finra.org). Cboe Fixed Income does not provide services to retail customers.