Global Markets

Tradable Products

Featured Products

Cboe Data Vantage

Analytics & Execution

Access Solutions

Indices

Other Solutions

The Key Features of the APA service include:

Benefits of the APA service include:

The Direct Reporting model is the standard model where firms can themselves submit trades electronically via a FIX or BOE interface. For technical information relating to the interfaces please see our Technical Specifications & Connectivity document library.

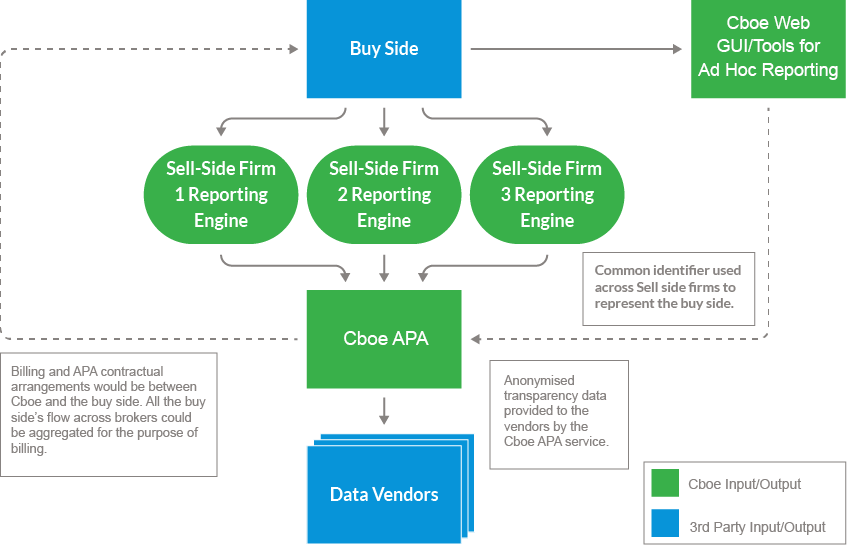

The Assisted Reporting model permits Investment Firms (typically buy-side) to utilise the technology of counterparties to assist them in meeting their regulatory responsibilities.

Under this model, firms would require a standard contractual relationship with Cboe and be subject to the standard pricing.

Key Advantages

The diagram below illustrates the Assisted Reporting model.

The MTF Reporting service provides MTF operators a facility to disseminate trade reports to the major market data vendors via Cboe’s outbound market data feeds. The underlying venue is identified on the trade reports enabling vendors to correctly attribute market share to the venues.

MTF trade reports can be submitted through existing connectivity to Cboe.

Please note: Subscribers do not need to be Participants of Cboe, but will need to enter into appropriate contractual arrangements.

The SI Quote Service provides a mechanism for registered SIs to meet their MiFID II OTC pre-trade transparency requirements. All trade reports associated with the SI regime are required to be reported in accordance with MiFID II reporting rules and flagged as SI trade reports.

SI quote data will be subject to automatic price checks to ensure data quality.

The SI quote data is disseminated on the Cboe market data feeds and is available via major market data vendors.

Please note: Subscribers do not need to be Participants of Cboe, but will need to enter into appropriate contractual arrangements.