Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Except for gold, implied volatilities for most asset classes ended 2025 near a 1-year low. And despite the unprecedented actions by the US in Venezuela over the weekend, cross-asset vols have remained remarkably calm so far. Even oil, which initially sold off on the news, have rallied back, with WTI 1M implied vol up just a modest 1.2 vol pts this morning.

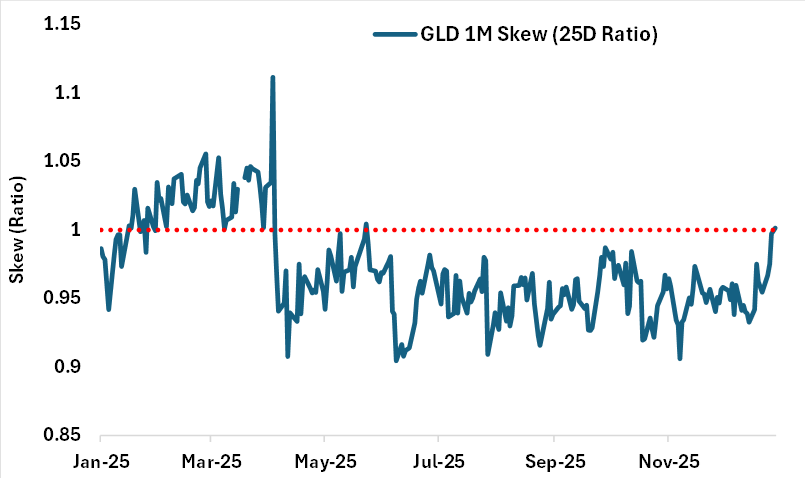

- Gold has been the biggest beneficiary of the geopolitical turmoil so far, up over 2% this morning. Interestingly, gold positioning had become a lot more defensive leading up to this weekend’s events, with GLD 1M skew steepening to the 80th percentile high on the back of increased demand for puts. For the first time since May, GLD puts are now trading at parity with calls (see chart below) suggesting traders see equal downside risk as upside potential for gold in the near-term. Longer term, investors are still bullish on gold, with GLD skew remaining inverted for tenors beyond 1M.

- SPX® skew flattened significantly in the last two weeks of the year as hedging demand dissipated during the holiday quiet, with 1M skew (25-delta ratio) falling from the 90th percentile high in mid-Dec to now the 40th percentile low. Tail risk hedgers, in particular, pulled back, with 1M put convexity (10D/25D ratio) falling to the 27th percentile low.

Chart: GLD Skew Steepening on Hedging Demand

Source: Cboe

[Download Full Report Here]

[Subscribe Here]