Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

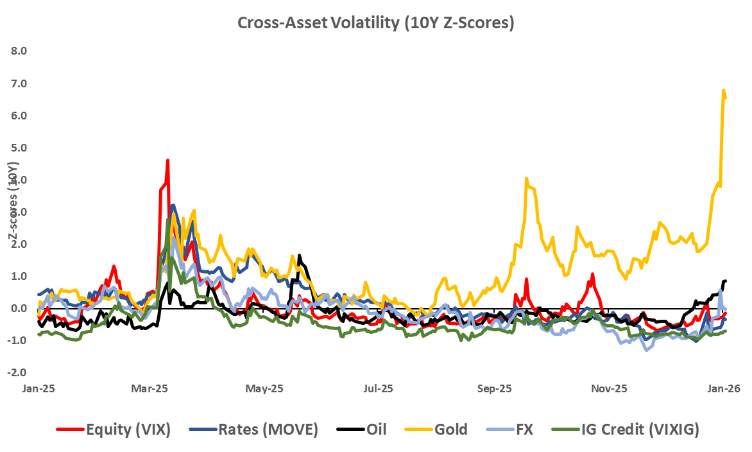

- Implied volatilities were higher across the major asset classes last week on the back of President Trump's nomination of arguably the most hawkish of the top contenders for Fed chair, Kevin Warsh. Although last Friday's 10% and 29% collapse in gold and silver prices doubled the 1M realized volatility of the two metals, the comparable maturity implied volatilities for GLD and SLV were significantly more well behaved and essentially followed skew downwards from 38.6 to 35.8 (GLD) and from 103.7 to 86.1 (SLV). As a result, ATM options on the metals are currently cheaper both from a nominal AND from a percentage of spot standpoint than they were last Thursday. That being said, implied vols for GLD and SLV remain near historic 7th standard deviation highs.

- Although the S&P 500® Index advanced 2 of 5 days last week for a w/w gain of 34bps, equity volatility, skew, and vol-of-vol have all risen with the VIX® index closing Friday's session +1.35 VIX pts w/w. Our Cboe VIX Decomposition tool shows that this positive DVol/DSpot dynamic can be almost entirely attributed to an upward shift of the volatility skew stemming from a market wide bid for optionality.

- Stock correlation has trended higher w/w but with 2/3 of the S&P 500 yet to announce earnings and four Mag10 companies (AMD, PLTR, GOOG, AMZN) set to release this week, correlation (COR1M) still remains at a low 10.8%.

[Download Full Report Here]

[Subscribe Here]

The information provided is for general education and information purposes only. No statement provided should be construed as a recommendation to buy or sell a security, future, financial instrument, investment fund, or other investment product (collectively, a “financial product”), or to provide investment advice.