Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

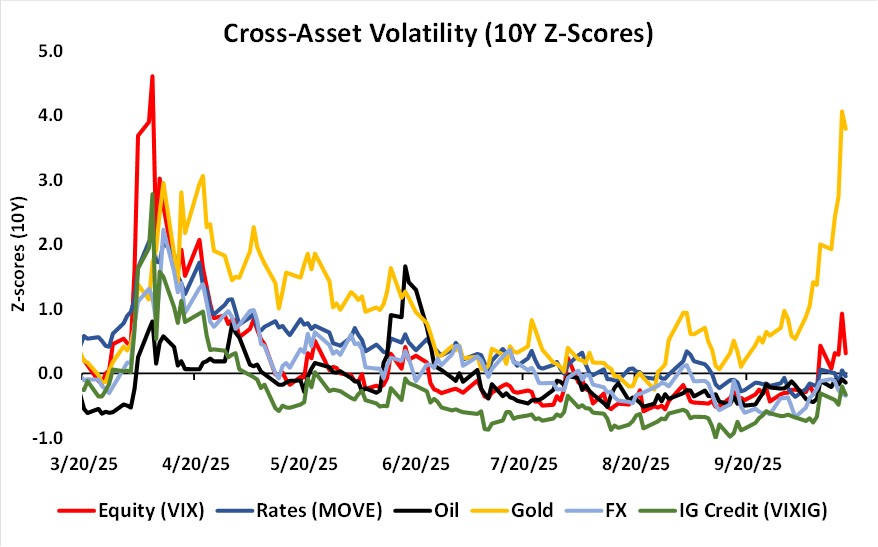

- GLD option volumes hit a record high last week, with over 2.1M contracts trading both Thurs and Fri (almost 5x the YTD ADV), driving GLD 1M implied volatility to a 5-year high of 30% and the 1M implied-realized vol spread to a high of 12.5%. Gold volatility ranks as by far the richest cross-asset vol, trading 4 standard deviations above its long-term average (see chart below).

- Concerns around regional banks led to a jump in credit volatility, with VIXHY index rising to the 72nd percentile high. There’s been very little contagion so far. While KRE (regional banks) 1M implied vol gained 5 pts last week, XLF (large cap banks) 1M implied vol fell over 2 pts on the back of positive earnings.

- While equities rallied last week, risk aversion increased as seen in several volatility parameters. Most notably, skew steepened and put convexity was bid, with traders selling upside calls to fund downside protection. This was most pronounced in the front-month tenor, with SPX® 1M skew (25-delta ratio) steepening to a 1-year high last week.

Chart: Cross Asset Volatility Snapshot

Source: Cboe

[Download Full Report Here]

[Subscribe Here]