Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Macro volatility declined last week following the Fed meeting, even as Powell injected more uncertainty into the December meeting. Both rates and FX volatility fell to a 1-year low following the FOMC, while gold volatility continued to normalize. In contrast, equity and credit volatilities increased wk/wk, with the VIX® index gaining 1.0 pt despite the market rally as SPX® fixed-strike vols increased (aka "spot up, vol up").

- SPX skew flattened further last week, as hedgers capitulated and call demand increased. The decline in skew over the past two weeks has been notable: SPX 1M skew has fallen from the 99th percentile high three weeks ago to a low of 6th percentile earlier last week, before ending the week at the 48th percentile. Longer-dated skew screens even cheaper, with SPX 6M skew now in the 16th percentile low.

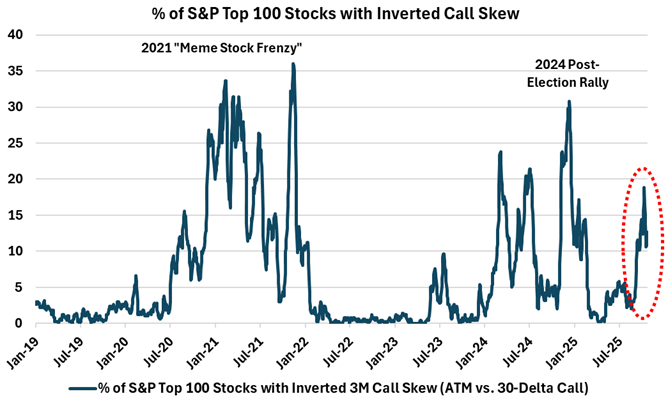

- The flattening in index skew is consistent with the pickup in bullish sentiment we’ve observed in single stock options. The number of stocks in the S&P top 100 trading with inverted call skew (a sign of extremely bullish sentiment) has surged to a high of 20% (vs. historical average of just 3%). While the metric is not yet at the extremes we saw in 2021 or late last year, it certainly signals a high level of investor optimism going into year-end.

Chart: Bullish Sentiment Jumps in Equity Options

Source: Cboe

[Download Full Report Here]

[Subscribe Here]