Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Implied volatilities gained modestly across asset classes last week as the US government re-opened and anticipation built ahead of key economic data releases this week. There is a pronounced kink in the SPX options term structure for this Thursday Nov 20th when the much-awaited Sep jobs report is expected to come out, with SPX weekly options currently implying ~1.6% move for Thursday.

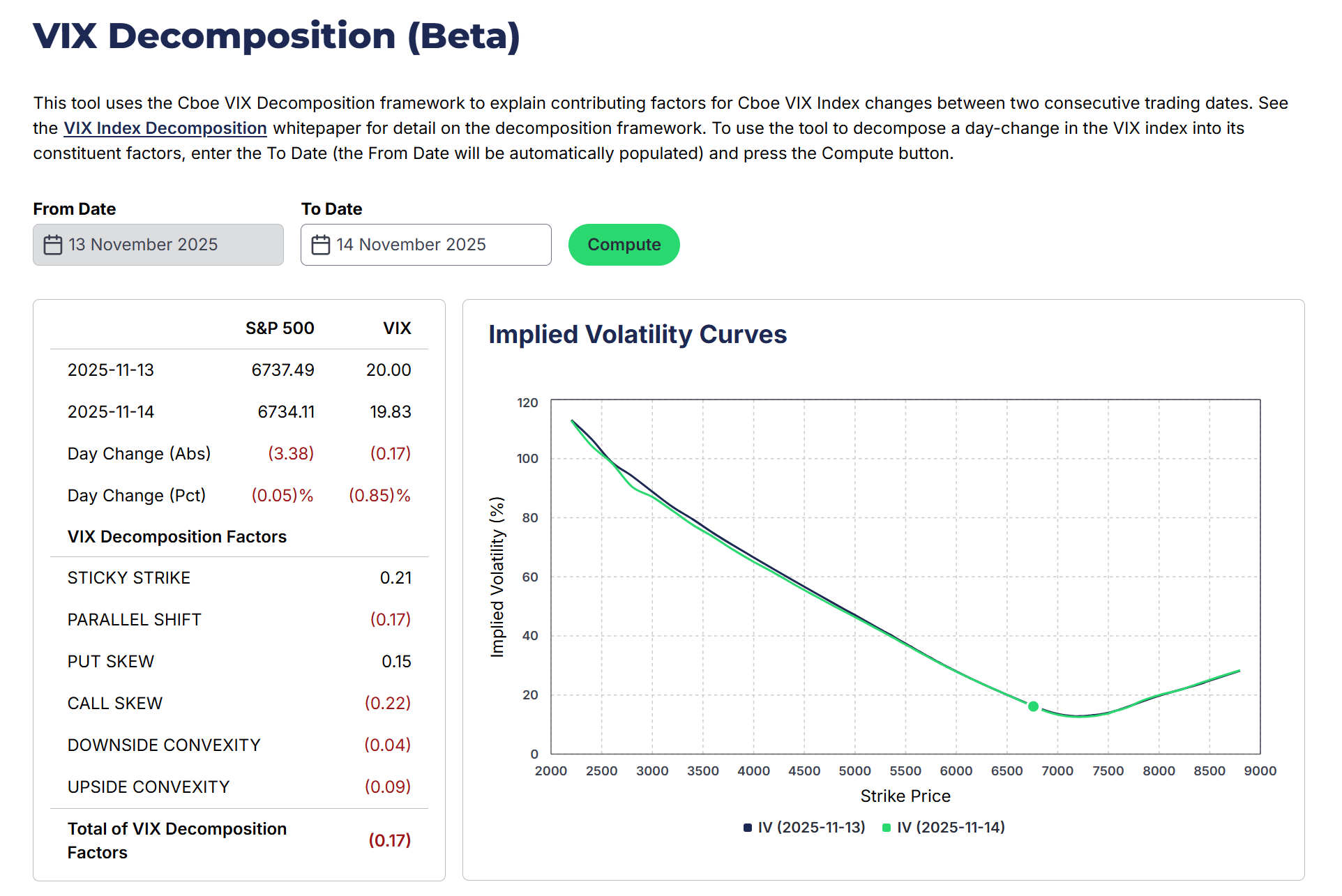

- While the SPX index ended the week unch’d, the VIX index gained 0.8 pt to 19.8% driven primarily by higher demand for puts. Increases in SPX put skew and put convexity contributed 1.1 pts to the VIX index move which was partly offset by lower demand for calls. Cboe recently released a web tool that allows users to track the VIX Index Decomposition on a historical as well as ongoing basis. Link to web tool here (see snapshot below).

- In relative value space, the QQQ-SPX implied volatility spread has widened notably, with the 1M vol spread surging to a 1-year high of 7.3% as Tech valuations and AI concerns escalate. All eyes on NVDA this week, where options are implying ~6.5% move on earnings.

Chart: VIX Index Decomposition Web Tool Now Live

Source: Cboe

[Download Full Report Here]

[Subscribe Here]