Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Implied volatilities fell across asset classes last week on softer than expected CPI and easing trade tensions. Equity volatility led the way, with the VIX® index down 4.4 pts wk/wk to 16.4%, falling to the 39th percentile low over the past year. Gold implied volatility moderated, even as realized volatility surged higher, driving the 1M implied-realized vol spread from a high of +9% to now -12%. Notably, investors used the sell-off to add to upside calls, with GLD skew becoming even more inverted over the past week.

- Rates vol declined last week on the back of the soft inflation data, with both MOVE and VIXTLT index falling to a 1-year low ahead of this week’s FOMC meeting where the Fed is widely expected to cut rates by another 25bps (99% implied probability in the OIS market). Very little volatility is priced into the equity market as a result, with SPX® weekly options implying just a 1.0% move for Wednesday – a typical one-day move with the VIX index at 16%.

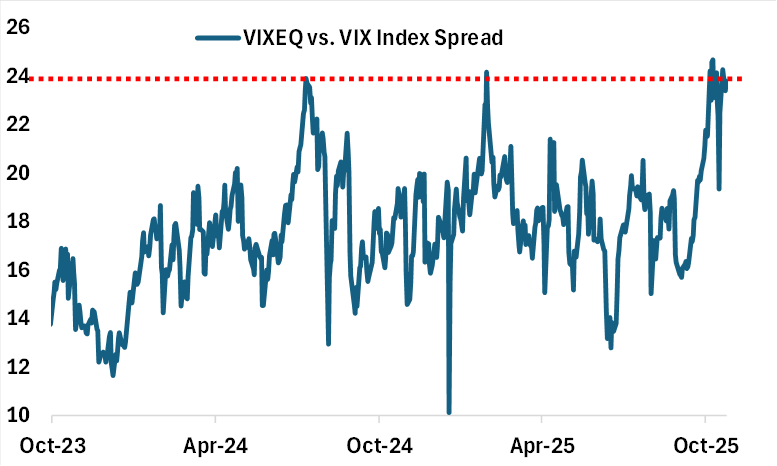

- The spread between single stock vol vs. index vol, as measured by the VIXEQSM vs. VIX index spread, widened back to near all-time high of 24% last week (see chart below), ahead of key tech earnings (5 of the Mag-7 companies reporting this week).

Chart: Single Stock Vol Trading at Near Record Premium vs. Index Vol

Source: Cboe

[Download Full Report Here]

[Subscribe Here]