Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Implied volatilities were marginally higher across the major asset classes (ex-commodities) last week. Following the retracement of US equities from record highs due to concerns of stretched valuations and indications of a cooling US economy, the volatility markets have started to demand a higher risk premium for assets with embedded corporate credit risk.

- After breaking 20 for the first time since mid-October following the historically low consumer confidence readings from UMich, the VIX® Index closed the week at 19.08. A VIX Index decomposition reveals the near-term S&P cross-sectional skew exhibits an increased bowing effect due to a bid for downside convexity via put-collars (OTM call-spreads sold to fund the purchase of DOTM puts).

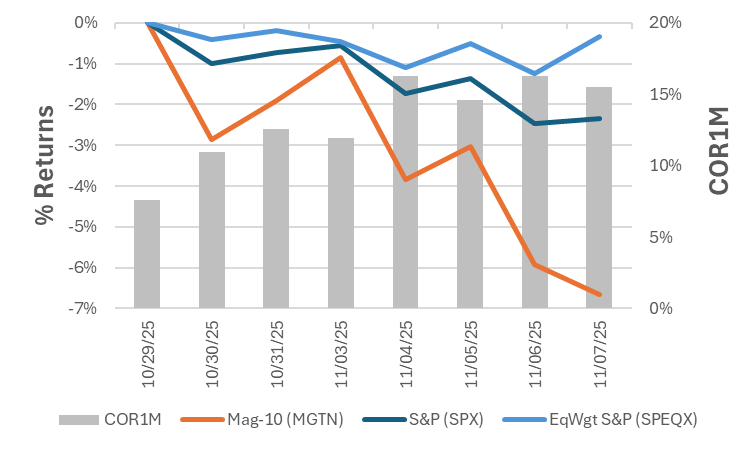

- As the markets enter the final stretch of earnings season with 95% of S&P 500 companies having reported, the -6.3% underperformance of Mag-10 stocks as a group relative to the broader S&P-500 amidst an increasingly hawkish Fed has driven a doubling in stock correlations (albeit at nominally low levels) from 7.4 to 15 post-FOMC. Accordingly, the equal weighted S&P-500 Index (SPEQW) has in turn outperformed the cap-weighted S&P-500 Index by 50bps over the same time period.

Chart: Correlations Bid on Mag-10 Underperformance

Source: Cboe

[Download Full Report Here]

[Subscribe Here]