Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Implied volatilities were higher across the major asset classes last week as the markets strove to process the economic implications of the US’ demand for Greenland. Gold and silver volatilities led the advance as prices for both metals set record highs. Option sentiment for gold was overwhelmingly bullish with continued demand for upside optionality for the safe haven asset; driving the call/put volume ratio to 4.2, more than double GLD’s typical call/put ratio of 1.8.

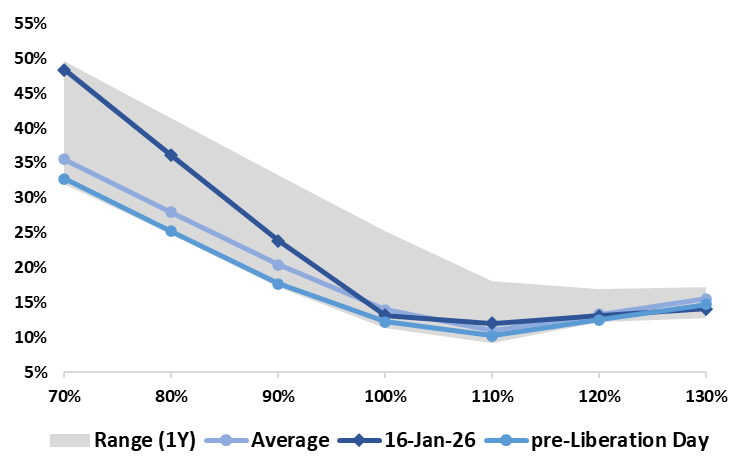

- Although the unexpectedness of last week’s geopolitical/ trade tensions initially sparked fears of a Liberation Day style market fallout, global equity volatility markets showed much more resilience this time around with the VIX® Index, VSTOXX and the VVIX Index rising roughly 20% of their respective Liberation Day increases before closing the week’s session only marginally higher across all three benchmarks. A large part of the reason why the equity volatility markets were so well controlled was due to the defensive positioning of traders heading into the event. As shown in the exhibit below, S&P skew heading into last week’s Greenland announcement was (and still remains) at a 98th percentile high, indicating an elevated level of downside hedging.

- Stock dispersion has steadily increased with the DSPX Cboe-S&P-500 dispersion index rising 5pts to 34.8 ytd as META, MSFT, TSLA & AAPL gear to report earnings this week. Despite geopolitical tensions, SPX implied correlation (COR1M) currently trades near an all-time low of 8.33.

Chart: Skew Steepness at 98th Percentile Highs Indicative of Heavy Defensive Positioning

Source: Cboe

[Download Full Report Here]

[Subscribe Here]