Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Implied volatilities were mixed across the major asset classes last week as traders jostled to reprice risk assets amidst the nebulous outlook regarding both the timing and depth of Fed rate cuts. Despite the whipsaw for Dec rate cut expectations over the course of the week, rate vols ended materially lower w/w with the VIXTLT falling from 94 (30th percentile) to 84 (8th percentile lows). Fed Fund futures are currently pricing in a 62% chance of a Dec cut – a 35% increase from mid-week lows.

- US equities traded under an elevated volatility regime last week with the VIX trading above 20 across all 5 sessions and peaking at 26.4 after Thursday’s mixed jobs report sparked “higher for longer” rate fears. A VIX Index decomposition reveals that despite the seemingly elevated levels, the VIX Index is trading only slightly (1.6 VIX pts) higher than market expectations. (i.e., Given the -2% w/w S&P decline, the pre-established skew as of the prior week anticipated a VIX Index close of 21.8 rather than 23.4.)

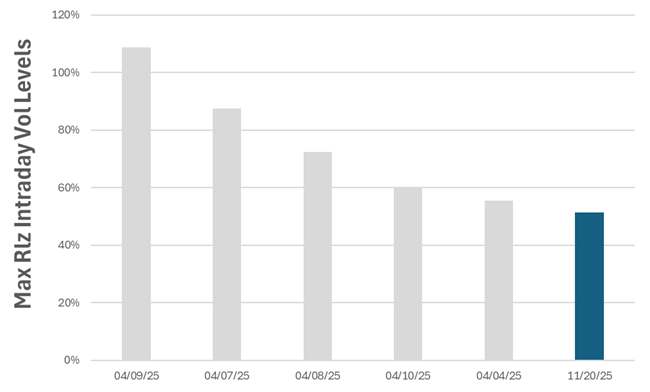

- The combination of Fed uncertainty and NVDA/ A.I. valuation concerns last week resulted in the highest spate of intraday realized volatility since Liberation Day and thereby offered a key opportunity for intraday traders to monetize long volatility/ short delta positions. For context, the average intraday realized volatility level of 31% last week was roughly double the intraday volatility levels realized post-Labor Day.

Chart: Fed Uncertainties Sparked the Highest Peak-to-Trough Intraday Volatility Levels Since April’s Liberation Day Catalyst

Source: Bloomberg

[Download Full Report Here]

[Subscribe Here]