Global Markets

Tradable Products

Featured Products

Cboe Data Vantage

Analytics & Execution

Access Solutions

Indices

Other Solutions

Index options are not limited to institutional investors. Nanos provide an accessible way to apply strategies similar to those used with standard-sized index options.

Nanos S&P 500 Index options offer exposure to the entire S&P 500 Index® at a fraction of the cost of standard contracts, often comparable to the price of a coffee.*

If you have a smaller account and believe index options are beyond reach, Nanos may be the solution. They offer the same benefits as SPX® and XSP® Index options but at a significantly lower cost.

Advantages of Index Options Compared to Individual Stock Options:

Diversification: A single trade provides exposure to 500 companies, ideal for taking action on a view of the broader market.

Reduced Single-Stock Risk: Minimize exposure to company-specific events [MS1] like earnings or mergers that can cause sharp price swings.

European Exercise Style: Index options cannot be exercised before expiration, unlike American-style equity or ETF options.

Cash Settlement: At expiration, positions settle in cash, no stock delivery or position management required.

Potential Tax Advantage: Index options may qualify for 60/40 capital gains tax treatment. Consult your tax advisor for details.

Nanos FAQs

How big is a Nanos options contract?

Nanos options are 1/100th the size of XSP options, which are 1/10th the size of SPX options. Because Nanos are smaller in size, their options premiums are proportionally smaller than those of their larger counterparts.

And when you buy a Nanos contract, the most you can lose is what you paid for it (the premium), plus applicable fees and commissions. If you sell an option, then your risk is theoretically unlimited, and should put at risk only the funds that you can afford to lose without affecting your lifestyle.

Does an S&P 500 Index-based ETF option trade around the same price as Nano index options?

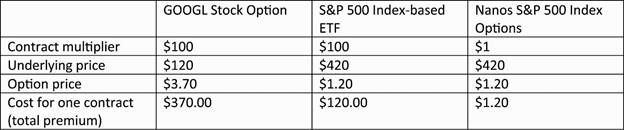

The underlying would trade at a similar price, however the options on these two assets would trade at different prices. There are differences you should understand.

What are some of the benefits of trading Nanos options?

It may be easier to see the advantage of trading Nanos with an example.

From the table above, you can gain S&P 500 exposure for as little as $1.20 per Nanos contract, allowing flexibility to purchase multiple contracts.

With $500 allocated to options strategies, Nanos allow multiple trades versus a single trade in a 100-multiplier contract, providing more opportunities to learn and manage risk.

Nanos provide a more affordable exposure to the S&P 500 Index, but they are still options contracts. Review the Characteristics and Risks of Standardized Options and consult your broker before trading. While risks exist, Nanos can offer a more accessible way to start exploring index options strategies. Consider starting with a paper trading account through a brokerage that offers Nanos. When moving to live trading, start with one contract, apply strategies thoughtfully, and focus on risk management and position sizing, key steps toward becoming a more informed trader.

*Nanos trade on Cboe as a $1 multiplier option (versus a $100 multiplier for standard options) on the Mini-S&P 500 Index, which is 1/10th the value of the S&P 500 Index.

Hypothetical scenarios are provided for illustrative purposes only. The actual performance of financial products can differ significantly from the performance of a hypothetical scenario due to execution timing, market disruptions, lack of liquidity, brokerage expenses, transaction costs, tax consequences and other considerations that may not be applicable to the hypothetical scenario. The inclusion of a security or other instrument is not a recommendation to buy, sell, or hold that security or any other instrument, nor should it be considered investment advice.

There are important risks associated with transacting in any of the Cboe Company products discussed here. Before engaging in any transactions in those products, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/us_disclaimers/. These products are complex and are suitable only for sophisticated market participants. In certain jurisdictions, Cboe Company products are only permitted for investment professionals, certified sophisticated investors, or high net worth corporations and associations. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. © 2025 Cboe Exchange, Inc. All Rights Reserved.