Global Markets

Tradable Products

Featured Products

Cboe Data Vantage

Analytics & Execution

Access Solutions

Indices

Other Solutions

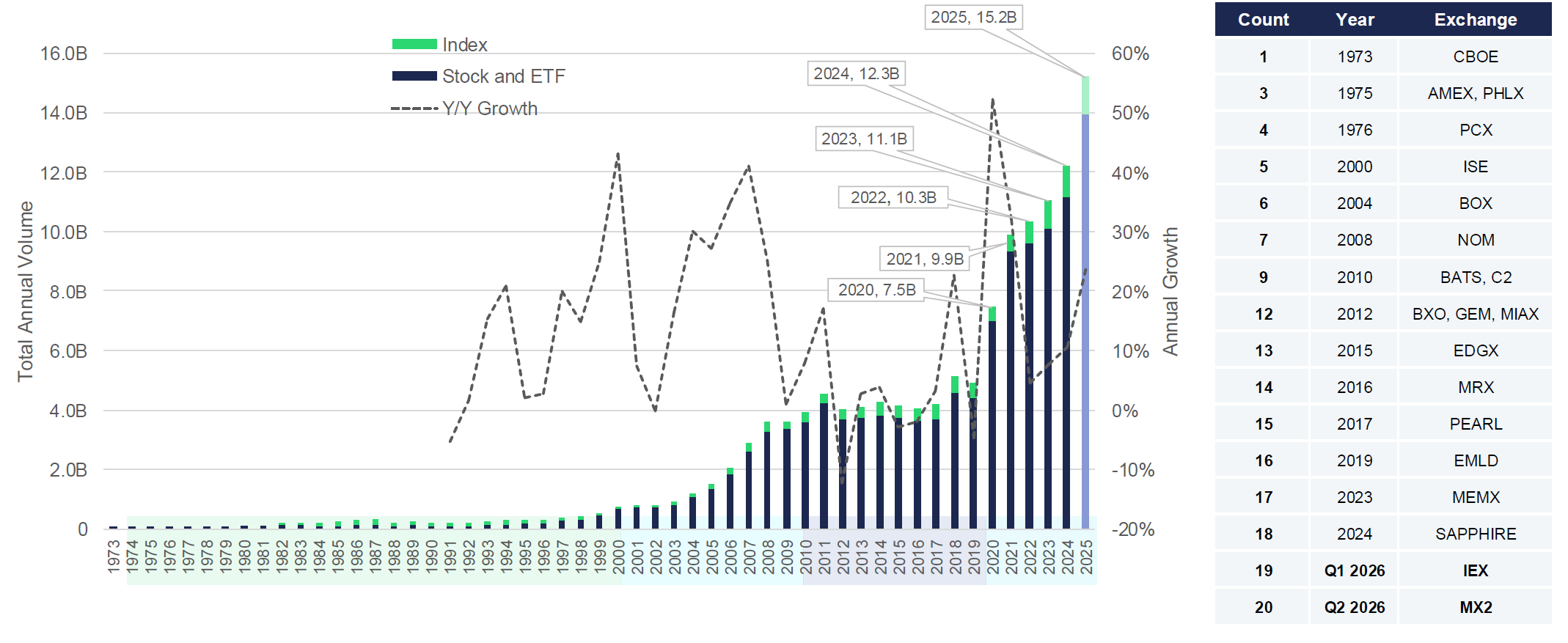

2025 was the sixth consecutive record year for U.S. listed options. Unprecedented industry participation was driven by strong equity performance, bouts of elevated volatility and increased retail and institutional flow. Total options volume topped 15.2 billion contracts in 2025, 26% above 2024 — the previous record.

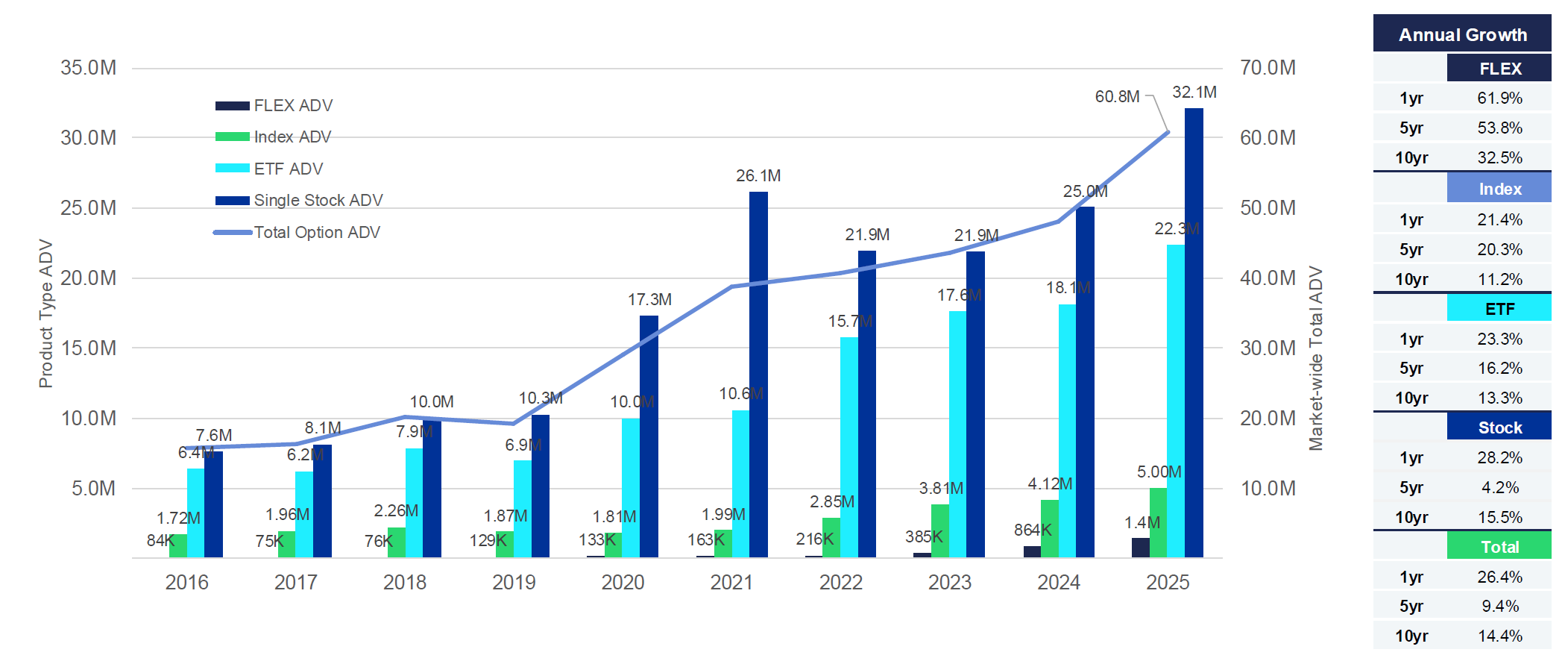

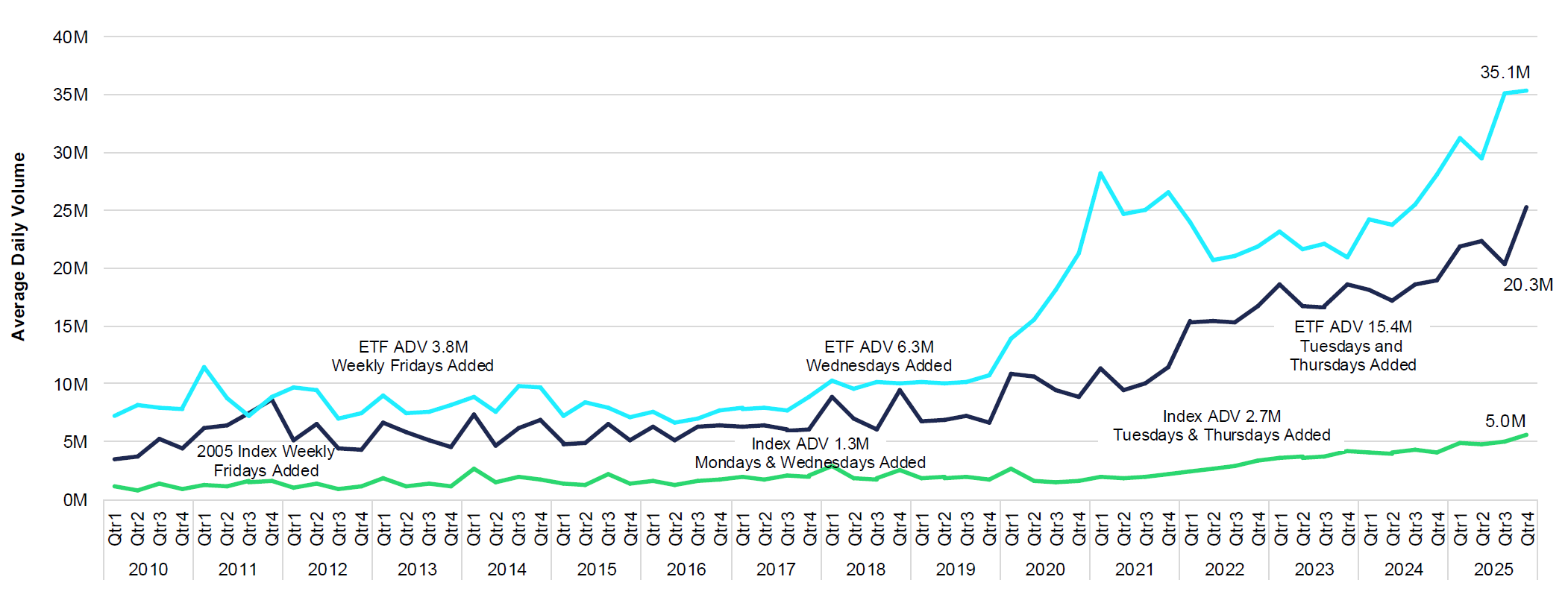

On average, 61 million contracts traded daily with strong growth in all segments including options on single stocks (+28%), ETFs (+32%) and indices (+21%). FLEX options volume was up nearly 62% to 1.4 million contracts daily, 10x the level traded in 2019.

Single day options volume topped 70 million contracts 21 times in 2025, including a historic first on April 4 when volume topped 100 million — eclipsed by a record 110 million contracts traded on October 10.

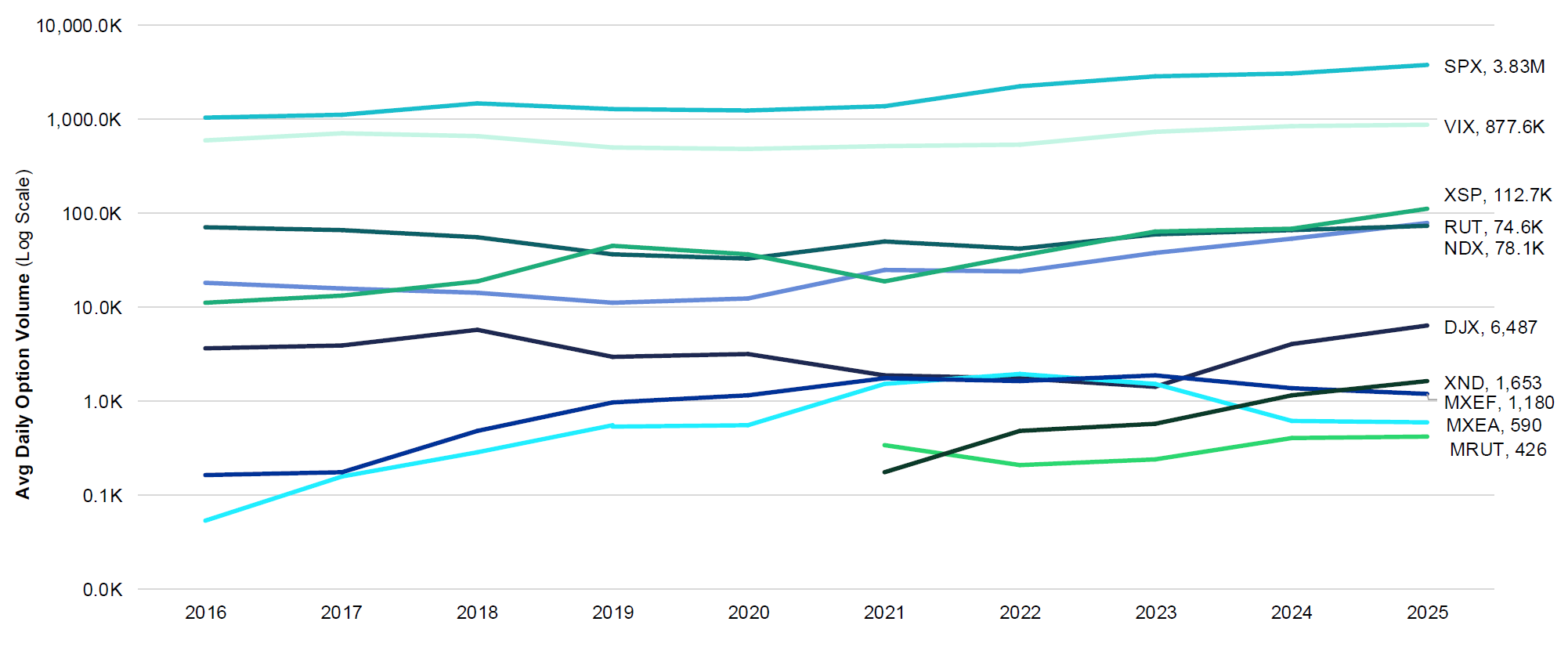

Index options volume increased to an average of 5 million contracts daily, including record average daily volume of 858,000 in VIX options and 3.9 million in SPX.

Zero days to expiry (0DTE) options in SPX averaged 2.3 million contracts daily, or 59% of the total product volume. Several new index products with daily expirations were introduced, including CBTX and MBTX Bitcoin ETF index options, and options on the equal-weighted Cboe Magnificent 10 index.

Additional industry milestones included the opening of a new trading floor in Miami, and the expected launch of IEX Options in 2026.

MEMX is expected to launch a second venue in late 2026, which would bring the count to 20 exchanges run by seven operators. Regulatory and brokerage trends favor further growth, with progress on the effort to ease pattern day trading rules for small accounts. Meanwhile, leading retail brokers have expanded product offerings to include a wider range of derivatives and prediction markets.

The industry is also preparing for more options products to be available during extended trading hours, as well as more expirations. AI and prediction markets are likely to play a key role in the options industry this year, as well, in addition to the growth of new products like dispersion futures, variance futures and 0DTE Exchange Traded Funds (ETFs).

Download the full State of the Options Industry report here.

The information provided is for general education and information purposes only. No statement provided should be construed as a recommendation to buy or sell a security, future, financial instrument, investment fund, or other investment product (collectively, a “financial product”), or to provide investment advice.