Welcome to the first edition of Market Metrics That Matter, your monthly briefing on European cash equities trends. In next month’s edition, we’ll also begin exploring off-exchange activity.

Don’t forget to visit Cboe Europe’s Market Share page for leading insights into European equity trading activity.

January 2026 Highlights

European equity trading volumes start the year strongly as activity shifts to Lit and Dark order books

- Total on-exchange average daily value traded (ADVT) in European equities reached €59.6bn, up 35% versus December 2025 (€44.3bn) and 30% versus January 2025 (€46.0bn).

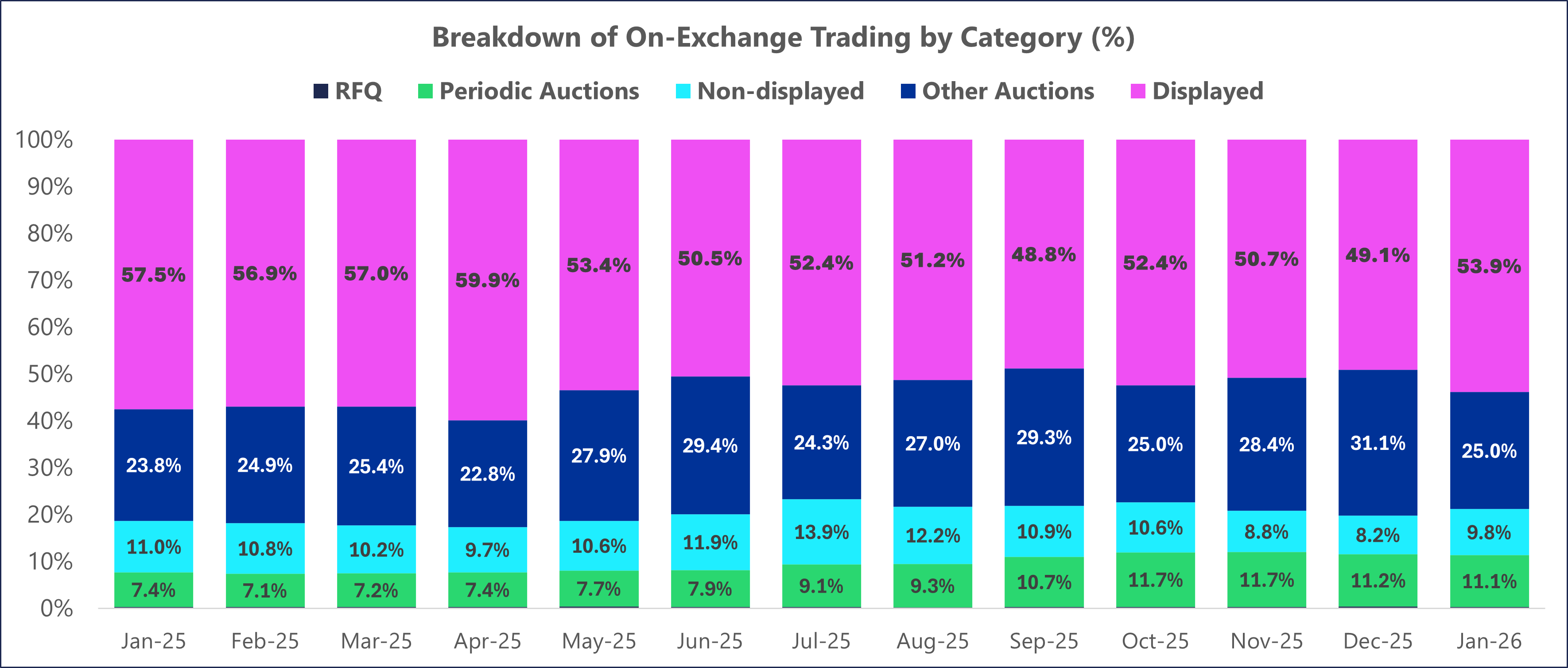

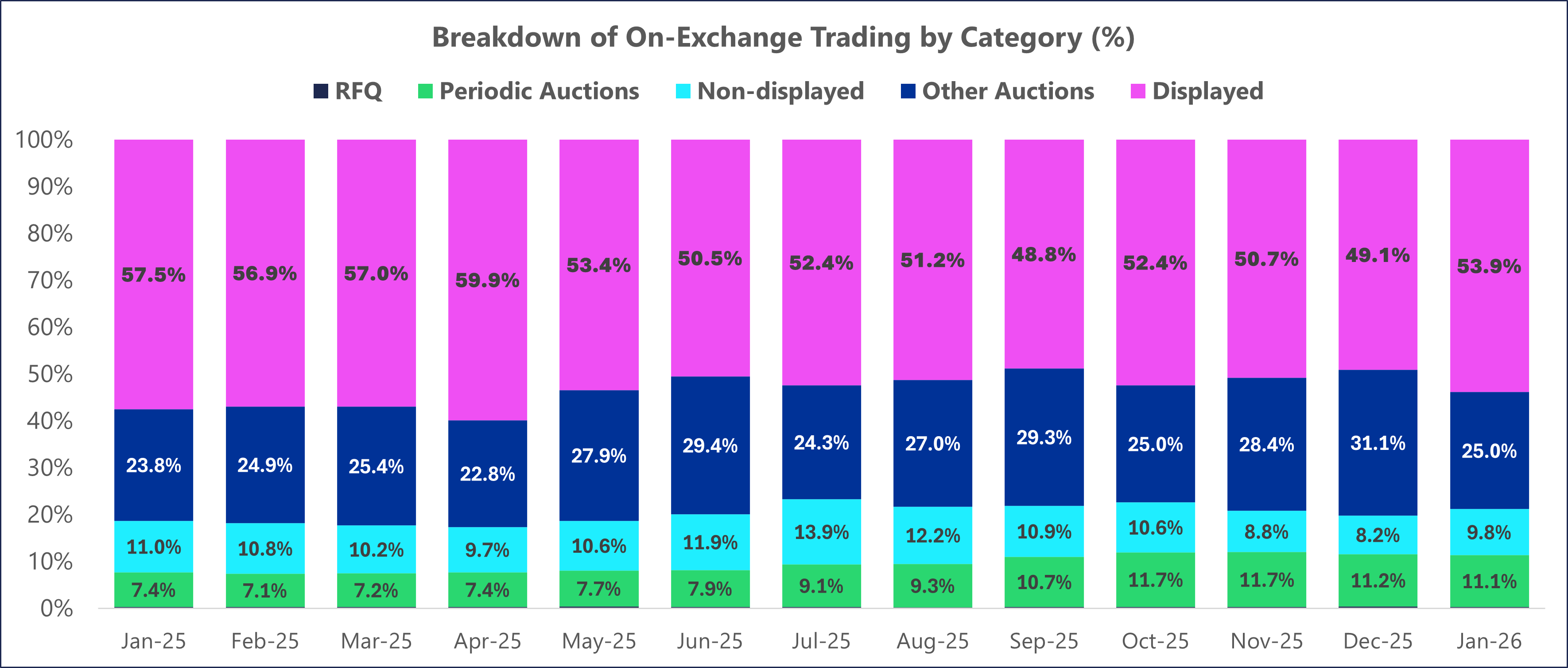

- Market-wide activity continued to shift away from open and closing auctions towards lit and dark order books. Lit order books accounted for 53.9% of on-exchange volumes, up from 49.1% in December 2025, marking their highest share since April 2025 (59.9%).

- Periodic auctions sustained their recent momentum, representing 11.1% of on-exchange activity - their fourth consecutive month above 11% - and recording a monthly ADVT high of €6.6bn.

- Frankfurt-listed securities recorded the strongest month-on-month increase in market share (+1.6 percentage points), while Zurich saw the largest decline (0.9 percentage points).

Cboe Europe posts largest market share gains, driven by mix of trading mechanisms

- Cboe Europe recorded an overall market share of 25.5%, up from 23.6% in December 2025, making it the largest pan-European stock exchange and the biggest month-on-month market share gainer.

- Cboe’s total monthly ADVT reached €15.2bn, up 45% from December 2025 (€10.5bn) and the highest level since April 2025 (€17.4bn).

- Cboe Periodic Auctions achieved a record monthly ADVT of €5.3bn, capturing an 80% market share of the periodic auctions segment.

- Cboe Europe executions against Retail Liquidity Providers reached a record monthly ADVT of €56.5m, including a record daily high of €82m on 19 January. Other key developments for the retail service, included: 12 brokers having now signed up to send retail-attested order flow; and five firms meeting the criteria of Cboe's retail liquidity provider programme. More information on Cboe Europe’s Retail EBBO service is available here.

- Cboe BIDS Europe, Cboe’s European block trading platform, remained the largest of its kind for the 46th consecutive month, posting its third-highest monthly ADVT of €762.0m and a record average execution size of €1.3m.

- Cboe VWAP-X (UK), our venue-based trajectory crossing service, achieved a record monthly ADVT of €5.6m.

Chart of the Month

Upcoming Changes

News and Insights