FLEX Options provide versatility to virtually every option strategy and precision to target trading objectives.

Please note: The Exchange may approve and open for trading any FLEX options series on any index, equity, ETF, or ETN that is eligible for Non-FLEX options trading in accordance with the Exchange's listing criteria, even if there are no Non-FLEX options on such listed on the Exchange. These include, but are not limited to, the following:

| Index FLEX | Equity FLEX | |

|---|---|---|

| Options Available for FLEX Trading |

|

FLEX trading available for all Cboe-listed equity options |

| Expiration Date | Up to 15 years from the trade date | Up to 15 years from the trade date |

| Option Type | Put or Call | Put or Call |

| Exercise Style | American or European | American or European |

| Strike Price | Index value, percent of index value or other methods | A dollar amount, percent of stock price or other methods |

| Premium | Percentage of the level of the underlying index or specific dollar amount per contract or contingent on specified factors in other related markets | A dollar amount, percent of the stock |

| Trading Hours |

|

Equity FLEX trading hours are 8:30 a.m. - 3:00 p.m. Chicago time. For trading hours on FLEX options on ETPs, please refer to the contract specifications. |

| Position Limits | Please refer to Cboe Rule 8.35 for complete information regarding Index FLEX position limits | Please refer to Cboe Rule 8.35 for complete information regarding Equity FLEX position limits |

| Exercise Settlement | All Index FLEX options are either AM or PM settled, subject to certain conditions described in the rules. Please refer to Cboe Rule 4.21 for complete information regarding settlement types | All Equity FLEX options are PM settled |

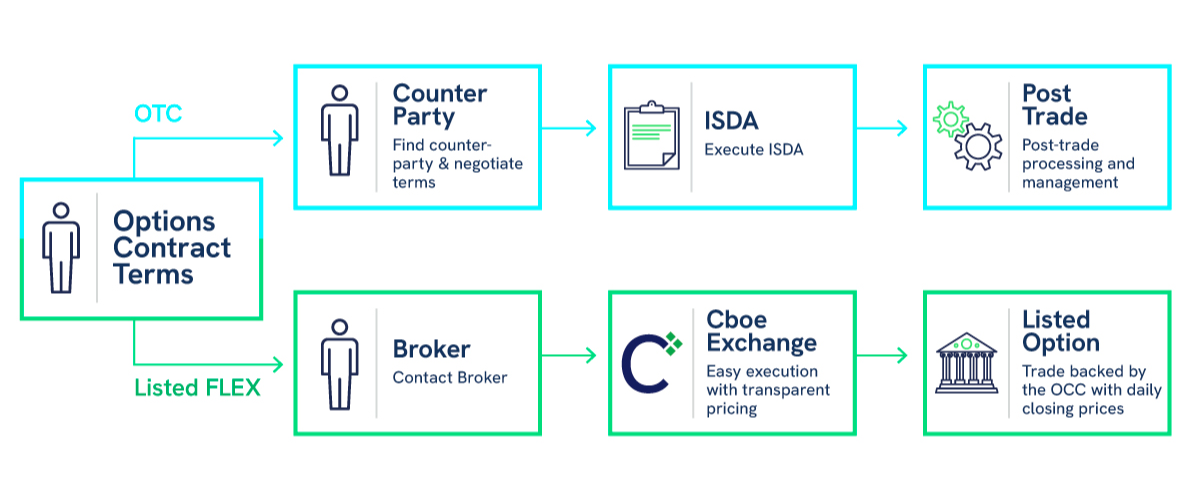

FLEX options combine the customization of Over-The-Counter (OTC) options with the ease and guarantees of listed options.

Asian and Cliquet FLEX Index options were developed to assist insurance companies with their hedging needs. Many insurance companies issue indexed annuity products where annuitants are provided with upside market exposure. This upside exposure is provided through various types of crediting methods. These crediting methods are nothing more than different types of options embedded within the annuities.

Two popular crediting methods employed by insurance companies are Asian options and Cliquet options. Asian options are also known as averaging options - their settlement price is determined by averaging a pre-set number of closing index values. Cboe offers a specific type of Cliquet option known as the monthly sum cap with a global floor where the payoff is the greater of zero or the sum of the monthly capped returns over the course of a year.

Prior to the listing of Asian and Cliquet options at Cboe, insurance companies hedged these exposures in the over-the-counter (OTC) market. Cboe's Asian & Cliquet FLEX Index Options offer insurance companies the customizable features traditionally associated with the OTC market along with the hallmarks of exchange trading like transparency, centralized clearing, and price discovery.

Cboe offers dozens of benchmark indexes designed to show the hypothetical performance of strategies that use FLEX options. Following are two examples from our Target Outcome Index Series that use S&P 500 Index FLEX options.

SPRO is a balanced composite index comprising the 12 monthly indexes in the Cboe S&P 500 Buffer Protect Index Series. SPRO is designed to track the returns of a hypothetical investment that, over a period of approximately one year, seeks to “buffer protect” against the first 10% of losses due to a decline in the S&P 500 Index while providing participation up to a capped level. Since inception, SPRO has had significantly lower volatility than the S&P 500 as demonstrated by standard deviation.

SPEN is a balanced composite index comprising the 12 monthly indexes in the Cboe S&P 500 Enhanced Growth Index Series. SPEN is designed to track the returns of a hypothetical investment that, over a period of approximately one year, seeks to provide 2x enhanced returns on the appreciation of the S&P 500 Index up to a capped level while providing one-to-one exposure to any losses. Since inception, SPEN outperformed both large cap domestic and international equities.

Silexx is Cboe's proprietary front-end offering for trading FLEX options on Cboe Options Exchange. Silexx FLEX option functionality includes:

Cboe Global Indices provides theoretical option pricing for listed index, equity and ETF options. Cboe Theoretical Option pricing can be derived from the bid, mid, offer and traded price on Cboe proprietary products [SPX, DJX, RUT, MXEA, MXEF, VIX] and listed equity/ETF options.

Cboe Global Indices follows internal compliance processes and control procedures that are reviewed on an annual basis. The controls processes implemented for the theoretical option price service are the same processes used for the calculation of Cboe's option strategy benchmark and indices.

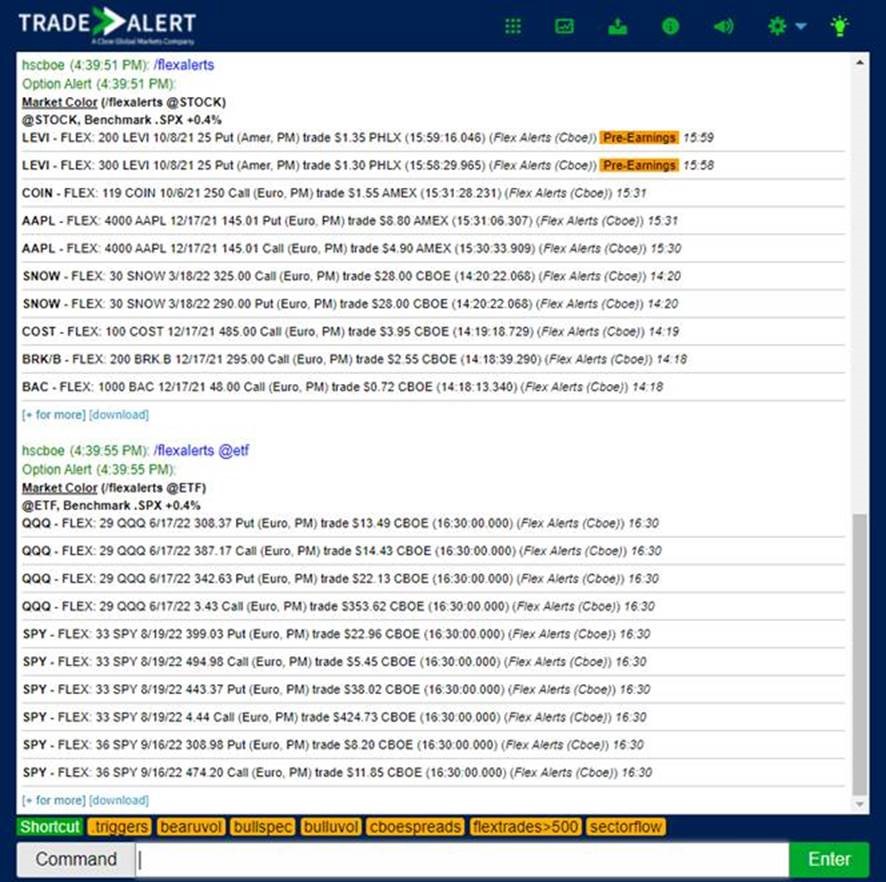

Trade Alert delivers timely, accurate flow analysis including directional sweep and complex order aggregation, unusual volume alerts, expert commentary, historical data and more.

Trade Alert provides alerts and recaps for FLEX trades in addition to recaps of FLEX open interest for current and historical dates going back up to 3-months.

TIMS®, STANS®, and OCC® are registered trademarks of The Options Clearing Corporation ® (OCC). OCC assumes no liability in connection with the use of STANS or TIMS by any person or entity. The current version of TIMS or STANS may not be reflected in the Cboe Hanweck services described herein.